This article is about the Investment products and expenses that come under section 80C of income tax act. Deduction under section 80C is available to all taxpayers. Be it salaried, business person or Retired, huf all can make investments in the specified list of products and claim deduction under section 80C.

Claiming deduction means that whatever you invest in the specified instruments, up to the maximum limit, will be deducted/reduced out of your total income and the balance income after applying deductions under other Income tax sections will be taxed as per income tax slabs.

The maximum limit of deduction under section 80C is Rs 150000

For some Rs 150000 per annum is a minuscule amount which gets covered in their EPF contributions only, but for many, this is a huge amount and sometimes the only saving that they can do in a single year. Thus, for the latter group of people, it is very important to use section 80C investments wisely. It is better to spread out the investment in different products.

If Invested wisely, section 80C investments alone can help in the complete financial planning for many. And Moreover, it’s not only about investments, some of your expenses also help you in saving tax under this section. So for higher income bracket people this could be advantageous to claim benefit of section 80C from expenses alone and Invest their money wisely in other open-ended instruments for their long and short-term goals

It is important to note that those who have income only from Capital gains, they are not allowed to take benefit of section 80C investments for tax saving.

Section 80C – Qualifying List of Investments

- Employee Provident fund (EPF)/ Voluntary Provident Fund (VPF)

Employee Provident fund or EPF as it is popularly called is not an alien product to anyone, especially the salaried people. EPF is the mandatory deduction of 12% from the basic salary of the employee. The same contribution is made by the employer. (Read a detailed post on the basics of EPF here)

If an employee wants to get higher amount deducted from his salary looking at the lucrative, fixed and tax-free rate of interest in EPF, then he may approach the employer and get his EPF account converted to VPF and starts contributing more than 12%, but maximum up to 100% of total salary.

Employee’s total contribution in EPF/VPF qualifies for Section 80C deduction.

In Budget 2021, it was proposed that interest on Employee Contribution to EPF/VPF beyond Rs. 2.50 lakhs per annum would be added to the total income of the individual and taxed as per Income-tax slab rates applicable, from FY 2021-22.

A Public provident fund account is the most popular product among investors. It is open to every individual. Unlike EPF, PPF can be invested in even by business persons. It’s 15 years lock-in product, but withdrawal is permitted on some conditions.

PPF is a fixed income small saving scheme backed by government of India. Rate of Interest in PPF and other small saving scheme is announced every financial quarter.

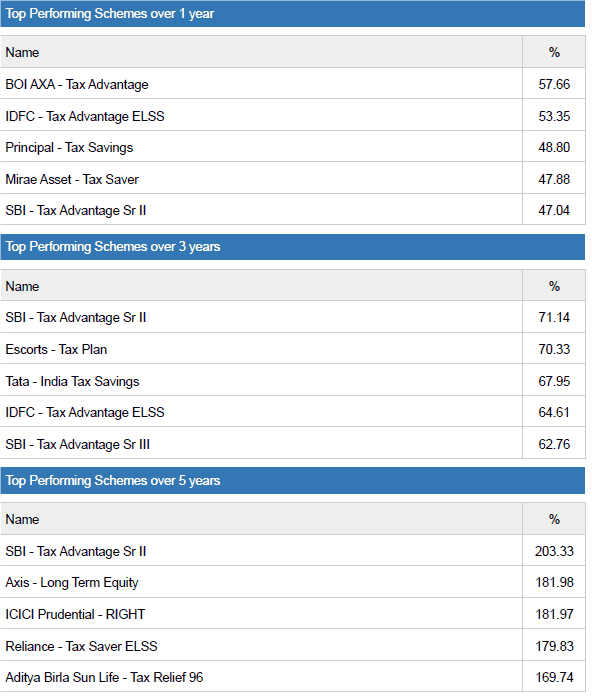

- Equity Linked Saving Scheme (ELSS) Mutual funds –

Not all mutual funds offer tax deduction under 80C. ELSS is the special category of Mutual fund approved and notified by finance ministry for this purpose. It is equity-linked mutual fund having a lock-in period of 3 years.

It’s a Market linked instrument and returns completely depends on how stock market and invested stocks perform in the particular scheme.

Though the lock in period is of 3 years only, but this is not a suitable time frame to invest in equity schemes. So, one should have a longer time horizon to invest in ELSS and enjoy the true benefit of the scheme.

Also, do not just look at the past returns but future requirement and your risk tolerance level to get into ELSS schemes. Understand equity investments to make the most of it.

This scheme can be opened in the name of girl child below 10 years of age. Investments can be made till 14 years from the date of opening of the account. It offers 0.5% rate of interest higher than PPF.

Sukanya Samriddhi account is the brainchild of Modi Government and was launched under the Campaign “Beti Bachao Beti Padhao”. And is a suitable scheme for those looking for safe and tax-free returns, along with tax saving under section 80C.

5. National Savings Certificate (NSC)

This is another one of the oldest tax saving instrument. It comes in 2 variants 5 years and 10 years. Both the variants are eligible schemes for deduction under section 80c.

The Interest rate like other small saving schemes gets announced every quarter, but unlike PPF which is a regular investment account, NSC’s interest remains fixed for its tenure as this is a one-time investment.

The Interest is compounded half-yearly, and the interesting part in this is that though taxable in itself, but its interest payments will also be counted for tax saving under section 80C.

6. ) 5 years bank /Post office Term deposit

Fixed deposits for the tenure of 5 years in any scheduled bank or Post office is also eligible tax saving instrument under section 80C.

Not all FDs come under this provision. So, do note that you have to inform the bankers beforehand while making this deposit and tell them that this FD is meant for Tax saving.

7. Life insurance Premium

Life insurance Policy premium paid for towards the life of Self, Spouse or children also comes under section 80C.

All insurance policies, be it term life, Endowment or ULIPs are part of this.

No deduction under section 80C is available for Life insurance premium paid towards Parents policy. Also, policy can be purchased from any life insurer, not necessarily only LIC

(Read: Online term insurance with Income benefits)

8. Senior Citizen Saving Scheme (SCSS)

SCSS is a Small saving scheme meant for Senior Citizens above 60 years of age. This is 5 years lock-in product with a maximum deposit limit of Rs 15 lakh. But the tax benefit u/s 80C is limited to Rs 1.50 lakh only.

This scheme has a high rate of interest with quarterly payouts. Interest is taxable.

Section 80C – Qualifying List of expenses

- Stamp duty and Registration Charges for home

When you purchase a house and pay stamp duty and registration charges for the same, that amount can be claimed under section 80C up to the maximum limit of Rs 150000.

- Repayment of Principal Portion of Home Loan

The principal portion of EMI payments on home loan towards residential house purchase qualifies for Tax deduction under section 80C. Do note that not the total EMI which also constitutes the interest portion of it, can be claimed under 80C, and only Principal part is eligible for it and Interest can be claimed under section 24.

(Read: All about Home loan tax benefits)

- Children School Tuition Fees

The portion of Tuition fees out of the total school fee paid to your child’s school/college can be claimed under section 80C. This benefit is available for maximum up to 2 children and is limited to the amount paid in the same Financial year.

The kind of rise in education fee in past years has led to the covering up of section 80C limit in the school expenses only for many.

(Also Read: List of Expenses which can be claimed u/s 80E, 80D, 80DD, 80U for tax saving)

Besides the above, there are some other Investments which though covered by different Income tax sections but comes under maximum limit of section 80C. These are Insurance pension products which are covered by section 80CCC and New pension scheme under section 80ccd (1).

However, In NPS you may invest Rs 50000 to claim tax benefit over and above the limit of Rs 1.50 lakh u/s 80C.

( Read more: SWP in NPS – Systematic Lump Sum Withdrawal in New pension Scheme )

Click here to check a detailed article on Income Tax Deductions.

How to make the best use of Section 80C investments for financial planning?

As you can see there are multiple products, which may suit varied needs of investment requirements. All the products will give you tax benefit under section 80c, but you should go with those which suit your long and medium-term goals too.

ELSS products do sound like a better choice looking at the return, but it comes with volatility too, so if you are average risk seeker then going with ELSS only will not make sense at all.

(Also Read: Save tax, the financial Planning way)

I believe you should start with Life Insurance, and get yourself adequate life cover from term life insurance products. PPF, Sukanya Samriddhi are the ones which give safe and tax-free returns but have a very high lock-in period. But if your requirement as per your financial goals is very long term then there is no harm getting into such products.

Go with NSC if you want safe returns with less lock-in, and also liquidity, as you can get Loan against National savings certificate.

All the instruments under section 80C have its pros, cons and risk factors. Follow a financial Planning approach to invest wisely.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

Hi, My mother is having 2 flats in different locations. One is self occupied & other is let out. Now another flat which both me & my mother are purchasing as joint owner & scheduled to be completed by 31st March 2018. Now due to some official issues, I am thinking to register that flat Only in my mother name, then what will be the tax implication, wealth implications on that new flat (3rd one for her) ?

Another doubt, can she claim deduction of the municipality tax that she pay annually in income tax? If yes, under which section it can be claimed?

There will not be any wealth implications since the wealth tax has now been abolished. and tax implications come when you are buying flat on loan or when you sell the house or when you are generating any income (Like rent) from that house. The owner has to pay tax on the income generated.

Municipality taxes can be claimed under income from house property if the property is on rent. Check out this article https://www.goodmoneying.com/income-house-property-tax-rental-income/

Really Good Information 🙂

Thanks

If I am investing in 5 year Post Office Term Deposits as resident and I am not employed, can deduction under section 80c be availed?

You can claim the 80 C deduction in the year in which you have invested in.

I want to invest my money for saving tax