Real Estate attracts everyone. Even if someone already has his own house or maybe a second house too or some commercial property in his or her name, the only idea of having one more property is enough to give a high.

But looking at the high property prices, real estate is not everyone’s cup of tea. Even for those who can afford they are reluctantly looking at the delay in constructions, lack of trust in builders and other visible difficulties in adding real estate in the portfolio.

A friend of mine recently read in the newspaper about the new REIT IPO, Mindspace Business Parks. He called me up and seemed curious to know about REITs. Of course, REIT has the word Real Estate attached to it, which is enough to catch the eyeballs.

I had a detailed discussion with him on Real Estate Investment Trusts. Since this would be an interesting thing to know for all, so I thought, to write a detailed post around this for the benefit of you and other readers.

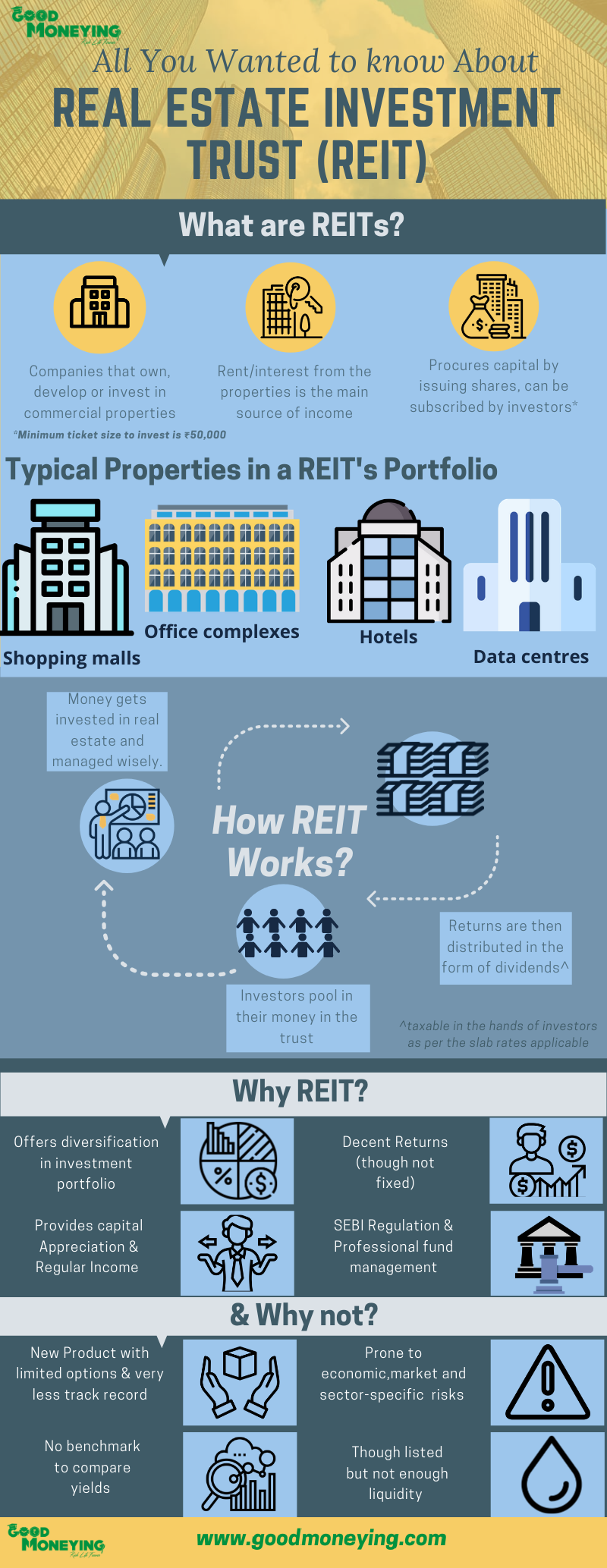

In this post, let’s talk about this new investment vehicle and see if REIT is a good investment or not. Do not forget to check out the infographic.

What are REITs?

REIT or Real Estate Investment Trusts, are companies that own, develop or invest in Commercial Properties such as- office complexes, shopping malls, data centers, hotels, warehouses, etc.

The prime source of revenue is Rent of the property or Interest on loan to build these properties.

In order to generate capital, just like any other company, they also issue shares in the market, which gives even a retail investor an opportunity to invest in the expensive commercial properties (indirectly), which they cannot afford to buy on their own.

However, it is important to note that the minimum ticket size to enter into a REIT investment is Rs.50,000.

In a way, we can say that REITs are similar to mutual funds, which pools money from different investors and invests it in different real estate projects.

(Also Read: What is Mutual Fund and types of mutual funds)

The rental or interest generated from these properties are distributed back to the investors, in the form of dividends.

Also, REITs are listed on the stock exchanges, just like any other shares, and can be traded or invested in there. Investors can also earn capital gains on the sale of REIT units.

(Also Read: 3 capital gain taxation rules you may not be aware of)

Apart from Mindspace REIT mentioned above, which got listed in August 2020, the other listed REIT is Embassy Office Parks REIT, listed in March 2019 are the only two listed REITs so far in India.

Another REIT, Brookfield India got listed in Feb 2021.

REIT- Regulation and Structure:

REIT works in a trust structure and is governed under SEBI (Real Estate Investment Trust) Regulations, 2016. Hence, there is effective control of SEBI on the functioning of the REITs.

In a REIT structure, the following are parties involved :

- REIT i.e. the Trust which holds the underlying properties, minimum net worth of the REIT should be 500 crores.

- Sponsor or group of sponsors (like a promoter in case of a listed company),

- Trustee of the Trust, and

- Manager i.e. the company or LLP which manages assets and investments and undertakes operational activities of the REIT.

Sometimes, rather than the trust directly investing in the property, it does through Special Purpose Vehicle (SPV). An SPV is a company or a limited liability partnership (LLP) in which the REIT holds or proposes to hold at least a 50% equity stake. An SPV is not allowed to engage in any activity other than holding and developing a property or any related incidental activity.

(Also Read: Role of Private Trust in Estate Planning)

Types of REITs:

REITs can be of three types:

- Equity REITs: These REITs own, develop, and manage the commercial properties and earn rent or lease from the same, which is distributed to the shareholders. Both the listed REITs are Equity REITs.

- Mortgage REITs: These REITs do not own any property, rather they provide loans to the developers, owners, or builders and earn interest in the form of EMIs and distribute it to the shareholders.

- Hybrid REITs: These are the mix of both Equity and mortgage REITs i.e. they own properties as well as provide loans to other developers and earn both rental and interest income.

REIT Investment Rules:

- REITs shall invest 80% of their assets in completed and rent generating projects. Rest 20% can be invested in under-construction properties, or in shares or bonds of other real estate companies.

- REITs shall at any point of time hold at least two projects, with not more than 60% of its assets in a single project.

- REITs are not allowed to invest in vacant land or agricultural land or mortgages other than mortgage-backed securities.

- REITs shall hold the property for at least 3 years from the date of purchase.

REIT Income Distribution Rules:

- REIT shall generate at least 51% of its revenues in the form of rentals or leasing of properties, except the gains on disposal of properties.

- 90% of the net income, whether rental, interest or any other income shall be distributed to the shareholders.

- Such distributions shall be declared every 6 months i.e. twice in a financial year and shall be distributed within 15 days of declaration.

- Sale proceeds of any property can be used to acquire any other property, within 1 year from the date of sale. If not so, 90% should also be distributed to shareholders.

Taxation of Income from Real Estate Investment Trust:

Taxation of Income Distributed by Real Estate Investment Trust:

As per Finance Bill 2020, with effect from 1st April 2020, any income distributed by the Real Estate Investment Trust, would be taxable in the hands of the investors and would be added to their income and taxed as per the slab rates applicable.

(Also Read: New or old tax slabs: what to choose?)

Also, the distributed income is subject to a withholding tax rate (TDS) at the rate of 10% for both Resident individuals and Non-Residents. However, the distributable income in the form of interest or rental would have a concessional withholding rate of 5% for NRIs.

In Budget 2021, it was proposed that TDS would not be applicable on REIT Dividends, with effect from 1st April, 2021.

NRIs can also take the benefits of Double Tax Avoidance Agreement (DTAA) provisions, if applicable. Read more on DTAA here

But, dividends received prior to 1st April 2020, would be tax-free for investors, as dividends were then subject to Dividend Distribution Tax (DDT) and are net of taxes in the hands of investors.

(Also Read: All About taxation of Mutual Funds)

Although, somewhere I have read that this dividend would remain tax-free for investors if the SPV distributing dividend has not opted for the concessional corporate tax rate of 22%. So, if earned, do consult your tax person on the same.

Taxation of capital Gains on sale of REIT Investment:

Any capital gain arising on sale of units (listed on stock exchange), exceeding Rs.1 lakh shall attract a tax rate of 15%+ cess, if sold within 36 months (3 years) of purchase and if held for more than 36 months, the gains (exceeding Rs. 1 lakh) would be taxed at 10%+cess.

These tax rates are the same for both resident and non-resident individuals.

(Also Read: New Rules for RNOR Status)

REIT Investment- Pros and Cons:

REIT as an investment, provides even a retail investor an exposure to commercial real estate, without bothering about identifying the right property and the hassles of paperwork. Physical ownership of real estate, particularly the commercial space not only is a time-consuming affair but also involves huge costs, which is beyond the reach of common masses. But, the REIT route makes it possible.

Real Estate Investment Trust not only provides liquidity to the real estate sector and boosts the infrastructure development in the economy, but also serves as a tool in the hands of the investors to diversify the investment portfolio, providing the investor both regular income (not fixed) and capital appreciation.

In addition, the investor interests also stand protected as the structure is regulated by SEBI and the investment and income distribution rules laid down by SEBI also look quite stringent, restricting mis-utillisation of funds. Funds are professionally managed as well.

But, it is also important to look at the Risks associated with the Real estate as a segment. So the economic risks and the financial risks of the company that manages it plays the role here.

(Also Read: Types of Risks in Investment and how to manage them?)

Also, as you know the rental yields in India, a developing country are not on the higher side, even in the commercial space (though better than Residential ones) . Being a listed entity, market risks would also be there, however, since the underlying product is Commercial Real estate, so the Regular income to the company in the form of Rentals would support the stock prices and generate recurring income for you.

So, expected post-tax ROI would be 7%-7.5%, though can’t be guaranteed. And may not look that attractive to the investors in the accumulation stage.

(Also Read: What is a good return on investment?)

Covid like situations may even worsen the things by decreasing the yields even further, as in many companies a majority of the employees are working from home and God knows when things will settle down! Defaults in rent payments can also be a possibility.

We do not have any benchmark to compare the returns with, just like we have for mutual funds. Minimum ticket size and requirement of demat account for investment may also be drawbacks for some.

(Also Read: How Mutual Fund Benchmarks help in comparing and selecting the right fund?)

Since these are new investment options, though listed but may not get enough liquidity.

REIT Investment (Infographic)

Are mutual funds allowed to invest in REITs?

It’s like you are buying equity of a company, having a Real estate portfolio, generating rental income or interest and some capital appreciation. If you don’t want to purchase this directly as a share, it may be encouraging to know that many mutual fund houses have exposure to the listed REITs in their portfolio.

Yes, mutual funds, except index and sector-specific funds can invest in REIT, but only upto 10% of its assets, with the restriction of 5% with a single issuer.

(Also Read: Index Funds in India: How attractive is passive investing?)

REIT: Should You Invest?

REIT Investment is still a comparatively new investment vehicle in India. As said earlier, only three listed options are available. So, it would be better to wait and watch this space and let some more options evolve which would help compare the performances and other parameters.

(Also Read: 5 ways to compare mutual funds)

But yes, it can be a good option to have real estate in your portfolio in financial form. It may not give you the returns as high as the physical Real estate would do, but the latter comes with its own risks, where the REITs answers most of them.

(Also Read: 10 reasons why Real Estate is more riskier than Equity)

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.