if you are a mutual fund investor or planning to be one, then it would be wise to know the taxation of Mutual Funds so you may plan your investments and withdrawals accordingly. Tax rules get reviewed every financial year, so it becomes necessary to remain updated with the latest rules to plan your finances well.

Taxation of mutual funds essentially depends upon three parameters:

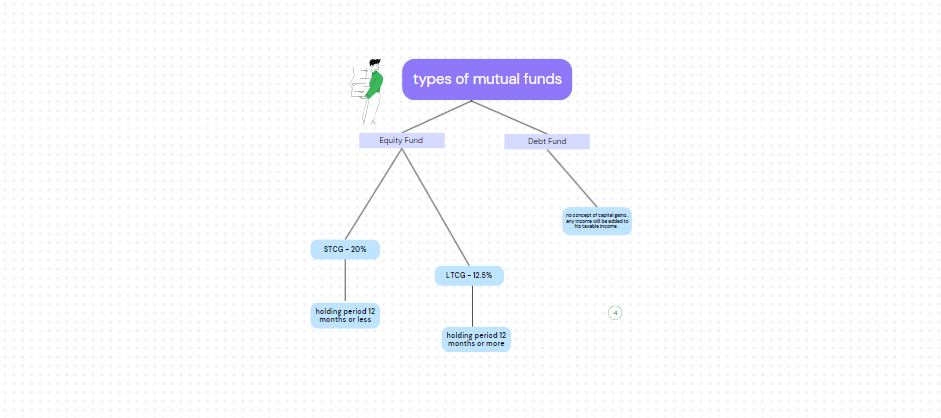

1. Type of fund you are in (Equity / Non-Equity / Specified funds): From the taxation point of view, mutual funds are broadly divided into two categories- Equity Funds and Non-Equity Funds.

Equity funds are those funds, in which the exposure to Equity and related instruments is 65% and above.

All other funds, that do not satisfy the above condition, are Non-Equity Funds, which means all categories of hybrid funds with less than 65% exposure to equity, Gold Funds, even International equity Funds, etc, all come under this category.

(Read: Mutual Fund types and concept explained)

(Also Read: How Good Is Gold as an Investment in India?)

Specified Funds – “specified mutual fund” means a mutual fund where not more than 35 percent of its total proceeds is invested in the equity shares of domestic companies. The definition of the “specified mutual fund” is to be amended from FY 2025-26 as (a) a Mutual fund that invests more than 65 percent of its total proceeds in debt and money market instruments; or (b) a fund that invests 65 percent or more of its total proceeds in units of a fund referred to in above sub-clause (a)

2. The Holding Period of your Investments (Long term / Short Term): Besides the type of fund, the holding period also plays a major role in determining the taxation of mutual funds. It can be either short-term or long-term.

- In the case of Equity Funds, if the holding period or duration of investments is less than 12 months, it is termed as short-term and when it is more than 12 months, it is termed as Long-term.

- In the case of Non-Equity Funds, if the holding period or duration of investments is less than 24 months it is termed as short-term and when it is more than 24 months, it is termed as Long-term.

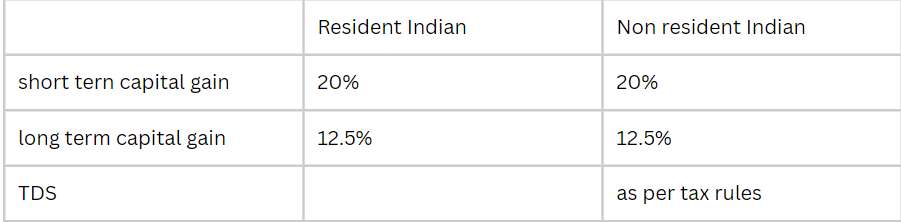

3. Your Tax Residential Status*: Your tax residential status also impacts the taxation of Mutual Funds. Tax Rules are slightly different for Resident Indians and NRIs. (Read: Who is an NRI? As per Income Tax & FEMA Rules)

*W.e.f 23.07.2024, there is no difference of capital gains tax rules for NRIs and Resident Indians.

Taxation of Mutual Funds- Equity Funds:

Mutual funds taxes come under Capital gains taxation.

In the case of Equity Funds, if the holding period is less than 1 year i.e. they are sold within 12 months of purchase, gains on the same are called short-term capital gains (STCG) and are taxed at the rate of 20%

When the holding period is more than 1 year, gains are taxed at the rate of 12.5%, However, gains up to Rs. 1.25 lakh would be tax-free per financial year. NRIs are also eligible for this 1.25 lakh Exemption benefit.

No TDS would be deducted in the case of Capital Gains earned by Resident individuals, but in the case of NRIs, TDS rates would be the same as tax rates i.e. 20% or 12.5%as the case may be. So, if the taxable income of NRIs is below the threshold limit, then they may claim a Tax Refund by filing an ITR on time. (Also Read: Benefits of filing ITR on time)

(Read: Mutual funds taxation – How it is different for NRIs?)

The below table summarizes tax provisions for Equity Funds:

www.goodmoneying.com

Important points to consider:

- In the case of SIP, every individual installment would be treated as a new investment. Long term capital gains would apply only when each of the installments has completed 12 months individually.

For example, you start a SIP of Rs. 10,000 in XYZ Equity Fund. After 12 months, if you wish to redeem the corpus, only the gains from the first installment would be treated as long-term, the rest would be treated short-term and taxed accordingly.

(Read: What is SIP in mutual funds?)

- Apart from this, a stamp duty of .005% is charged at the time of purchase of mutual funds, and an additional tax of 0.001% on equity funds is also levied by the Ministry of Finance as Securities Transaction Tax (STT). This STT does not get levied on funds other than Equity Mutual Funds.

Taxation of Mutual Funds- Non-Equity Funds:

In the case of non-equity funds, If the holding period is short-term (i.e. holding period less than 24 months), the gains out of the same are called Short-term capital gains (STCG). They are added to the income of the individual and taxed as per the income tax slab, in the case of both Residents and NRIs.

(Read: Old or New Income Tax Rates- what to choose?)

However, a TDS @ 30% is applicable in the case of NRIs on short-term capital gains. But if this is the only income that NRI has and the total amount of gain is less than the basic exemption limit i.e. Rs 2.50 lakh currently, then NRI may claim the TDS Refund by filing ITR.

(Also Read: Taxation of NRE Fixed Deposits for Returning NRIs)

When the holding period is more than 2 years, gains would be treated as Long-term capital gains (LTCG) and will be taxed at 12.5%and are taxed at the rate of 20%, with indexation.

Taxation of Mutual Funds – Specified Schemes

Specified schemes are defined in Budget 2023 and the same was revised in Budget 2024. These schemes are taxed as Short-term capital gains of Non-Equity funds. No Long term gain rule applies to these.

In short, the gains booked in these will be added to the total income of the Investor, and taxed as per the IT slabs one falls into.

The same rule applies to NRIs too.

Also, Check- Tax Rules for ULIPs post-Budget 2021

Taxation of Mutual Funds- Dividends:

From FY 2020-21, dividends paid by Mutual Funds, whether on Equity or Non-Equity funds, in short-term or long-term, would be taxable in the hands of the investor. The dividend would be added to the total income of the investor and would be taxed as per the applicable income tax slab rates.

For instance, the one falling in the 30% slab, will pay tax at that rate and the one falling in the 5% slab, will pay tax at that rate.

Mutual Fund houses also have to deduct TDS at the rate of 10% on the dividends paid more than Rs. 5,000 per year.

In the case of NRIs, both the TDS and tax rate are 20%. However, this rate can be even lower if the provisions of DTAA are availed. This is because the tax treaties with most of the countries limit the taxation on dividends between 5% to 15%.

( Read: All about Double Tax Avoidance Agreement (DTAA))

Advance-tax liability on dividend income shall arise only after the declaration/payment of the dividend.

The taxation rules remain the same in the Dividend payout as well as the Dividend reinvestment option.

In the end-

As written in the beginning, tax rules get tweaked yearly and may impact your investments too. Though I will try to update the article with the latest rules, still before taking any investment decision referring to the tax rules written here, do consult your CA or a Financial Planner. Or ask in the comments section below for verification

Hope, the write-up clears all your doubts about the taxation of mutual funds in India, if you have any questions, feel free to ask in the comments section. Also, if you find it useful, do share it with your family and friends.

regarding long term cap gains on unlisted equity shares when can you use market value as on 30th jan 2018 as cost of aquisition. buy back of shares by company is exempt right

As per our understanding, you may not be able to use the market value of the unlisted shares as of 31st Jan 2018, as the taxation of unlisted shares is different than that of the listed ones. In the case of unlisted shares, the indexed cost of acquisition from the date of purchase is considered to arrive at the gains and on which a 20% tax is applicable.

But please be informed that we are not tax experts. Please consult a good chartered accountant with your query.

What will be capital gain tax on selling shares within a month?

Any gain arising out of selling equity shares within a period of 12 months on any recognized stock exchange, would be treated as Short Term Capital Gains & taxed at the rate of 15%+ applicable surcharge/cess.