Health Insurance policies Offered by Nationalized banks are gaining attraction these days. The first thing which attracts the most is the Low premium. Of course, the cost is one of the main factors which make people think that they are still healthy and if they really require health Insurance coverage or not 🙂

I happened to look at a few of the health insurance policies by nationalized banks when one of my clients asked me the suitable one for his uncle and parents, and I actually find them worth considering.

Though I never advised any of my clients to buy such policies, due to presumed services issues but still for those who are finding difficulty in getting mediclaim coverage from anywhere, and are finding the market premium to be unaffordable, they can consider these policies, but only after understanding the pros and cons. Low premium should not be the only factor leads to your decision. (Read: How to select best health Insurance policy in India?)

I am going to write a series of article with detailed reviews of some of the health insurance plans being sold by nationalized banks. This article is covering PNB Oriental royal mediclaim policy

PNB Oriental Royal mediclaim policy – In brief

Nationalized banks in tie up with general insurance companies (Nationalized/Private) have come up with special products for their customers and bank employees. These are exclusive offerings to their account holders, under group insurance scheme.

PNB Oriental Royal mediclaim is one of such product, which is offered by Punjab national bank to its customers and employees in association with Oriental Insurance Company Limited. Through this policy, account holder or employee can cover Self+Spouse+2 dependent children under family floater coverage.

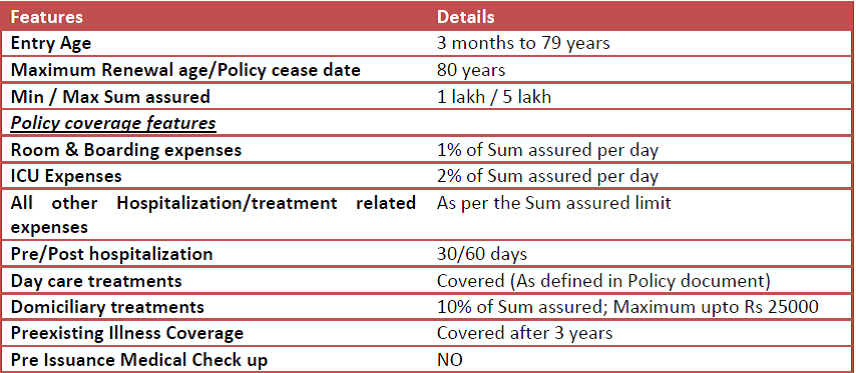

PNB Oriental Royal Mediclaim policy- Key Features

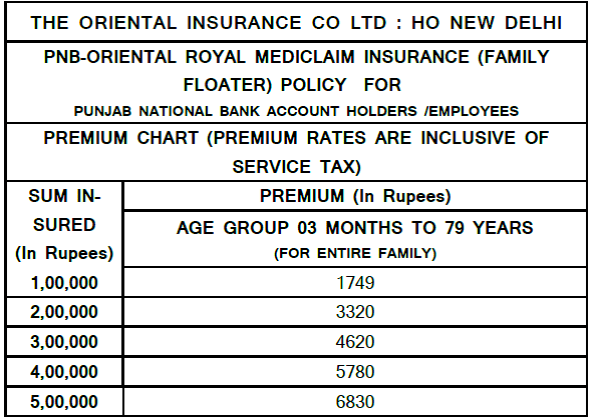

PNB Oriental Royal mediclaim policy– Premium Chart

(Click to Download the policy document/wordings)

PNB Oriental royal mediclaim policy – Should you buy?

Well this is a decision which i have to leave with you. But let me share my observations which may help you in your decision making.

The premium rates are no doubt mouthwatering, especially when the premium rates are same for all age groups till 80 years, and market rates of individual policies are way ahead of this.

The main point to consider before deciding to buy this or not is that this is a group health policy and the result of special tie up between banks and insurer, once the tie up is over which can happen anytime and due to any reason then what would happen to existing policy holders? (Read: Mediclaim for parents – Other options)

As per IRDA guidelines existing policy holders in group policy can move to individual policy of the same insurer (Oriental in this case) and chose the policy best suitable for his needs. Of course at that time policy holder may have to manage with higher premium and different terms and conditions. However they will be offered with continued coverage i.e. they will get the credit of Preexisting and waiting periods already spent in the earlier policy.

The entry age in this policy is as far as I know is maximum in the Health insurance policies offered by nationalized banks. In fact even in individual policies, it is difficult to find policies after 65 years of age. So if you are not finding any suitable policy for your parents you may get them insured from here, by opening their bank accounts with PNB.

As banks are acting as intermediary in this case, so you will not get any Policy servicing or claim related support from them, you have to take the entire headache yourself and communicate directly with TPA and Insurance company.

Oriental being a nationalized insurer has a defined list of network hospitals, and thus there are conditions on claim repayment in case policyholder gets treatment in non-network hospitals

So as you see that there are both pros and cons while going in for PNB oriental royal mediclaim policy. If you find high pros as per your requirement and you can handle the service issue well, then you may consider going in for this policy. Else you may wait for my reviews on other such health policies being offered by banks.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

A COMPREHENSIVE ANALYSIS OF GROUP POLICIES OF 10 MAJOR BANKS

With health costs escalating at a rapid pace every year, it is important for every individual to have a health insurance policy. There is a plethora of options available in the market offered by both public sector and private players.

However, it’s been noticed that health insurance products by private players were more popular in the market, with even online comparison portals displaying products only by private players. On the other hand, many nationalized banks offer health insurance products in tie-up with health insurance companies like United India Insurance Company Ltd, National Insurance Company Ltd, New India Assurance Company Ltd and Oriental Insurance Company Ltd. Bank mediclaim policies, though attractive in many ways, are not popular and well-researched. Keeping this in mind, I am presenting a few options offered by nationalized banks.

Why should you go for a health insurance policy by a nationalized bank?

Buying a health insurance policy from a bank is pretty simple. The only pre-condition is to be an account holder in the bank. The most important benefit is the unbelievably low premium rates to cover your family, as compared to a private player. To put it in perspective, a family floater policy (account holder, spouse and two children) for a sum assured of Rs. 3 Lakhs with Punjab National Bank costs Rs. 4,536 (latest premium amnt may increased by Rs.500 approximately) per year, compared to Rs. 11,390 per year (without sub-limits) and Rs. 8,542 per year (with sub-limits) with ICICI Lombard. This vast difference in premium works out to a huge amount over the long term. Policies also come with no medical tests and have a high renewal age. You also have the option of adding your parents in your policy in many banks. This can be especially beneficial if your parents do not have a medical policy of their own, as buying individual mediclaim for parents is expensive.

Most banks tie-up with public sector players. More than one bank can work with the same insurer. Before choosing your bank, it is important to consider the claims settlement history of the insurer as well.

What are the drawbacks in a health insurance policy by a nationalized bank?

The biggest problem in taking a health insurance policy from a nationalized bank is the poor service quality. But it’s a not a major issue because the interaction with the bank is only during submission of proposal form. Thereafter the insurance company or it’s TPA person will assist you in your need. If you do not mind some hiccups in service quality and can work through the bank’s system, you can consider a bank mediclaim policy on account of the low costs.

I have analysed health insurance products of 10 nationalized banks on the basis of several parameters, as under:

Premium amount: Most banks offer a flat premium not linked to the age of the insured. This can be useful, as you will have to pay a lower premium even with an increase in age. Banks like Corporation Bank, Union Bank of India and Indian Overseas Bank have different premium rates for different ages. In comparison with peers, this can work out costly if you fall in the higher age bracket. Premium charged by Union Bank of India & Andhra Bank is the highest among banks in my analysis. Cheap premium plans are available with Bank of Maharashtra, Bank of Baroda, Bank of India, Punjab National Bank, Syndicate Bank and Oriental Bank of Commerce.

Pre-existing diseases coverage: All banks have a 3 year waiting period for pre-existing diseases except Corporation Bank which requires 4 years. Generally, it is required to have 3 claim-free years with no hospitalization during that period.

Sub-limits: Expense limits are more stringent with Andhra Bank, which caps expenses on room, nursing, ICU charges and Pre and Post hospitalization charges. Bank of Baroda & Bank of Maharashtra don’t have sub-limits for room rent and ICU charges.

Major Exclusions: All policies give a list of items which are specifically excluded from coverage. Maximum exclusions are specified by Andhra Bank, Corporation Bank and Canara Bank. Pregnancy related benefited are excluded from Andhra Bank, Bank of Baroda, Canara Bank, Corporation Bank, Oriental Bank and PNB, while domiciliary hospitalization benefits are excluded from Andhra Bank, Bank of Maharashtra, Corporation Bank and IOB.

Additional coverage: It is best to choose a plan which is comprehensive and covers the maximum risk possible. Even if the sum insured is the same, there are other benefits you must check, which include OPD cover, maternity benefits, personal accident-death benefits, health check-up and domiciliary hospitalization benefits. Maximum additional covers are available in policies by Bank of India, Indian Overseas Bank, Bank of Maharashtra and Canara Bank.

Which policy should you buy and which should be avoided?

If you are not looking at coverage for parents, you can consider Bank of India or Bank of Maharashtra which is both low on premium and has other important benefits. You can also look at Bank of Baroda, Oriental Bank of Commerce or Punjab National Bank if you are not looking at coverage for parents and maternity benefits. You can also go in for the policy by Bank of Maharashtra as it covers all important benefits. However, if you are above 65 years, you will have to get a medical checkup done. Canara Bank is a good choice if you are not particular on domiciliary hospitalization benefits.

Type of policy: All banks offer a family floater policy, covering the account holder, spouse and two dependent children. Some banks like Andhra Bank, Bank of Maharashtra, Canara Bank, Indian Bank and Indian Overseas Bank offer plans to cover the primary account holder’s parents as well, for an additional premium.

Age of insured: The maximum age of entry is a critical aspect, as healthcare costs shoot up after 60 years. Policies by Indian Bank and Punjab National Bank have the highest maximum entry age of 80 years, with Oriental Bank pegging this at 79 years. The renewal age is up to 80 years for all policies in our analysis, except Corporation Bank, which is much lower at 70 years.

Sum assured: The minimum sum assured is as low as Rs.50,000/- for most bank mediclaim policies. The maximum sum assured amount is Rs.5 Lakhs for all policies, except for Indian Bank, which is at Rs. 10 Lakhs.

It is best to avoid policies by Andhra Bank and Indian Overseas Bank as the premium is high compared to the other banks we analysed. Corporation Bank can be considered if you fall in a lower age bracket; however, if you are in a higher age bracket (above 45 years), it is best to avoid this as well.

In general, most banks offer similar benefits and features but for minor differences. Apart from the outliers mentioned above, you can choose a policy from a bank which is most easily accessible to you, as you will need to maintain an account with that bank.

If you are very particular for online option (to apply as well as renew the policy) the best choices are Indian Bank & Bank of Maharashtra.

For more regulatory details of group mediclaim policies, click here :

http://www.policyholder.gov.in/…/Renewability%20of%20Health…

http://www.policyholder.gov.in/Group_Insurance.aspx

Thanks for sharing

Expecting you review on Canara Mediclaim, Maha Bank Swasthya Yojana & Indian Bank Arogya Raksha policy. All the bank policies are revamped now and few of them are offering life long renewal as well as higher sum insured.

Sure.

Great Analysis Rajesh Babu and Manikaran Singal.

I have a small query : My parents are aged 67 and 71. I applied for Canara Bank – United India Assurance Mediclaim. But the insurance agency guy who came to collect papers from bank called to inform that parents cannot be included if the age at start of policy is beyond 65. Is that true ? The brochure that Canara Bank gave said the policy can be taken till 80 years

Please confirm and letme know what I should do.

As per the product brochure, entry age is only till 65 years. However the age limit can be relaxed to 80 years of age which is completely Insurer’s prerogative.

You may try with PNB policy if you have account there..as they have provision of entry age till 80 years

Exceptionally good reviews by Manikaran and Rajesh! Manikaran you touched the most sought for topic, your name again pulled me to the famous Manikaran Gurudwara. Rajesh you are good in detailing, loved your write up. Can an unmarried lady(already a policy holder) add her spouse after marriage in PNB Royal Mediclaim policy?

Thanks Murali for your nice words. I don’t think adding the name of spouse would be any problem, but that is possible only at the time of renewal. Still you confirm this question from oriental people.

Hello,

I have by parents covered for 5 lacs through oriental insurance. They are 73 and 70 years of age respectively. The premium I am paying is Rs 35000/- approximately. I am considering going in for the policy through PNB bank so that the premium goes down for the same amount insured. My father had undergone heart surgery in 2009 and has since not claimed anything so far. Would his heart problem and diabetes be covered under the new policy I plan to take. Would it be wise to go in for the pnb insurance tie up? Please guide.

See, first thing you cannot port your existing policy into this PNB group policy. So you need to start from scratch, which means that if accepted you need to wait for 3-4 years to get the heart problem and diabetes covered under this plan. So to me it doesn’t make any sense, its better to continue with the existing coverage

Can you pls review & do comparision for super topup plans? Especially Hdfc super topup

Sure. I have already done a review of apollo Munich optima super top up http://www.goodmoneying.com/insurance-planning/apollo-munich-optima-super-top-health-insurance . it may be of some help.

Is there any co-pay in this PNB Oriental Policy?

No. I have not read any co pay condition written anywhere.

The biggest drawback of this policy is SUBMIT CLAIM FORM & DOCUMENTS within 7 DAYS after discharge. Lot of hassle for policy holders & their family members

Thanks for Information Yogesh. But I think these terms are generally flexible and if one can justify the delay in the covering letter while submitting the claim form then the claim should be accepted.

Sir, I have a mediclaim policy from starhealth of Rs 5 lac.(self+spouse and two children covered with flatter policy) policy is expiring on 17 april 2017. If at that time I apply to pnb mediclaim policy from my account then above star health policy’s continuation is applicable or not?

You may continue 2 policies together, and even claim from both the policies if sum assured in one policy is not proving to be sufficient

My father n mother aged 58 n 56 , no major problem. Exclude thyroid n bp. Can I go for this policy in family floater. 1 policy for them . And one for me n wife aged 30-31 years. We all already holding a policy of MD India health care.

kindly suggest best. I m already account holder. So if I takes my wife n son will be covered in floating without having pnb account. And my father account opening under process ( father HUF account is with pnb , it will work ?? ) kindly suggest.

Ronak somani

99 77 88 99 55

Ronak, this policy is only for the account holders of Punjab national bank. So to buy this policy you have to have account with PNB, then you can buy the floater or individual option whatever suits you.

I have PNB oriental policy for 5 lakhs. Can I take Canara Apollo Munich policy also to get lifelong renewal and after 3 years stop PNB oriental policy .

In PNB policy,Treatments for health complication such as aesthetic dental treatment, circumcision, eye surgery, AIDS, HTLD-III, pregnancy, obesity, non-treatment hospital visits, accident from adventure sports, massages etc. are not covered.

My question is which bank includes above?

Good Point.

ORIENTAL BANK OF COMMERCE also provides this facility to their account holder.

Secondly, while buying policy, if you opt for TPA services then a patient can get cashless service from the hospital.

Thirdly, if treatment is taken from government hospital or non-network hospital then patient should be ready to make rounds of TPA or Health Insurance company. In this case even the patients of highest paid premium health policy need to go number of times to TPA or office of health insurance for getting claim.

please send me list of network hospital of PNB oriental insurance.

Sir, please consult PNB or Oriental executive for the same.

I have account in PNB but I have not cheque book. So can i also apply for insurance?

How to down load my renewed PNB-ORENTIAL RPYAL MEDICLAIM POLICY SCHEDULE.

I am looking for health insurance for my father in law. His age is 61 and he has undergone by-pass surgery. Could you advice any policy as I understand that many insurance companies will decline the application for pre-existing medical history. I need on a urgent basis.

Thanks

Indranil

Yeah, it would be difficult for a person to get health cover who has already got his bypass surgery done. Still, there is one policy with Star India which is specifically meant for heart patients. You may like to go through that

Dear sir,

I am krishnan, (Age 44) and I am much impressed with your article and advice.

I need your suggestion regarding below

For my family I have taken PNB group policy(5Lks) before 6 months. (Myself, wife, and son)

I am personally having HDFC ERGO (Individual – Health suraksha silver – 4Lks) which completed 4 years period and which need to be renewed shortly.

Now I need to pay premium of 12K (2 years policy)

Moreover my company also providing me a group coverage with ICICI ( myself only)

Can I continue this HDFC policy in future or Group policy is enough to fulfill the needs.

Please advice.

Thanks

Krishnan

My view is you should continue with HDFC Ergo. This is the only dependable policy in your health insurance profile 🙂

Thank you sir

Krishna

Group policy is enough to fulfill the needs

Thank you sir

Hello

Pnb royal med policy coverd critical disease or not

Cancer , heart attack or kidney etc

Hospitalization is covered due to any illness

Recently premium hiked but not edited on NET

pl,check….

Common man can not accept it.

Not affordable premium.

This is very important in our life but premium is not affordable to all income category people.VERY SORRY TO SAY BUT IT IS VERY BAD THAT PREMIUM PRICES HIKED BY 2.5 TIMES..REALLY BAD….

Yes, true. Premium for above 60 increased from approx 7k to 20k. with effect from April 1. Bank is looting all in the name of PSU. Better go for andhra bank or even Apollo Munich from canara even if premium is higher. At least service of apollo is good

You are right, but the premium to claim ratio and profitability have to be taken into consideration as well. Even I was surprised when suddenly they increased the premium from 7K to almost 20,000.

My parents are covered in this policy for last 7 years and I have had the benefit of getting claims twice from the same policy amounting to greater than 2 lakh in last 2 years. So retrospectively it was an awesome decision to get this cover. sadly I lost my mother to illness, but for dad, I will continue with the policy for continuity benefit till they are giving this service.

P.S. Best for people above 45 years, but not at all bad for young ones too

I have one Pnb oriental health insurance policy with shibpur branch ,Howrah, WB. I wish to know the details of enhanced rate as well as any modification of policy.

Dr Prasad. Please contact Insurance company for this

Rate is revised from April1 renewals. For above 60 rate is 20k for 5 lacks policy. Most un-affordable policy among PSU banks. Other PSU offer larger choices at around 7.5k. Oriental have really disappointed everyone.

I have policy since seven years for 4 laks can I increase the policy to 5 lake by paying additional premium. My policy is renewed on fab.18

Manikarn, Awesome article which I have read and re-read many times in last few years and have strongly advised many of my friends and family to go for such group products for parents above 45 or 50 years. serves best for them.

One simple request to you to please update these articles with the latest revised rates and benefits( Not much of a task for you 🙂 ) if not maybe you could just add revised rate charts.

I have the PNB one they have increased SA options upto 10 Lakhs and three age slabs 0-40, 41-60, 61 and above

Deepak Thanks for the suggestion. Actually, the problem in updating the rates is that if not available online, many of the bankers are either not aware of the product or are not open to sharing the latest premium details with all. Not sure Why? or what are they afraid of.

Still Will try keep doing this.

Due to wrong actuarial process Group Banka Tie Up policy with The Oriental Insurance Co. Ltd. v/s PNB, OBC has to revised premium upto 4-5 times in Dec. 2017. So Next better option is Canera Bank V/S The New India Assurance Co. Ltd. Tie up is having premium for Sum Insured Rs. 10 Lac premium Rs. 30 days from 1st inception of the Health Policy. So keeps your worries out and go to take Canera bank tie up Health policy.

CAN A PNB ORIENTAL ROYAL MEDICLAIM POLICY CAN BE PORTED TO STAR HEALTH OR TTK CIGNA HEALTH POLICY?

No. Group Policy cannot not be ported to Other insurance company’s Individual policies

Sir I have total 3 policy’s. But I am so disappointed with new premium. It is so high. I belong to middle-class family. But problem is that your premium direct go high 200%. So now I am decided to go cancelling all 3 policy’s due to increase premium.

After renew my old policy….be seriously we are facing very problem at the time of hospitalizing…. Very bad service guys….and itne mails karne par bhi koi reply nhi aaya…. Atleast humko apni pocket se payment dena pada…. Insurance team ne bola ki apki koi policy review nhi hoi hai…

Thanks Deepti for sharing your experiernce. It will help the readers in making wise choice

Hello,

Last year i paid 7886rs…but now renew value so high… 19452rs.. why ?

Hello,

Last year i paid 7886rs…but now renew my old policy value so high… 19452rs.. why ?

Dear Sir,

Good Afternoon !

I am from Delhi I want to buy a Mediclaim policy for my parents. When I search on Google, there is a lot of confusion, where many private companies are available, which provides this facility. But they have too much premium. It is not possible to afford low-income people.

Sir, Kindly suggest to me can i purchase a Oriental Royal Mediclaim policy for my parents. Where premium is very cheap compare to others. But in this only one drop back, which is for portability. If customer not satisfied with those services, they have no options.

You have lots of experience, Kindly suggest the actual feedback for oriental or any other policy which is suit for my parents.

My parents age is (Father) 64, (Mother) 62.

Prompt response will be highly appreciated

Thanks

Good for needy.

My post hospitalisation charges in pnb royal Orient insurance are not being passed in bilateral knee surgery on the grounds that it is package payments in cashless treatment.i claimed for physiotherapy and medication.they are denying my claim.i attended ombudsman hearing where Orient insurance took the package REIMBURSEMENT payments not morethan this.

Please advise me for further action.

my mother is 55 and father is 65. Can i take this policy by paying the premium for my mother as the policy is covered for both?

Once the insurer ends the tie up with the Bank, most Banks tie up with another insurer, so in that case as well, the coverage is there (as Bank of India changed from NIC to Reliance). I am not sure about the claim service of such policies, can you please through some light on the same?

Can I port from a individual health insurance policy of united India insurance to PNB Oriental Royal Mediclaim policy?

No Harish..it would not be possible. We can’t port an individual health policy to a group policy.

My parents mom dad are age around 72 I am dependent daughter age of 40 we can take policy all together

As far as the information we have, this policy is discontinued.

Really, I enjoy your site with effective and useful information. What is the minimum premium for health policy?