Seeing the Past years’ Average and Absolute performance, one of the blog readers emailed me his investment portfolio to review and asked about the 2024 strategy for “long term growth”.

I wonder if it was for Long term growth then why he wanted to have a 2024 strategy.

Anyhow, I never review the Portfolio just like that, I just asked him a few questions to have him review the portfolio himself. For the benefit of all readers I would like to share those questions in this post.

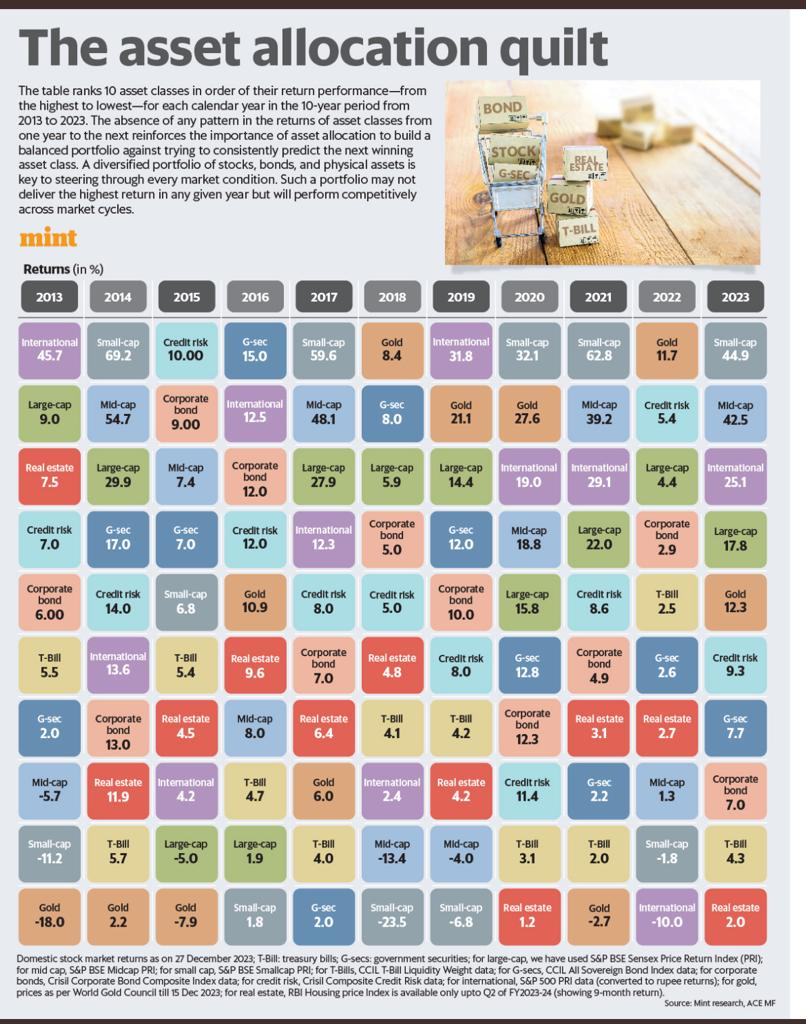

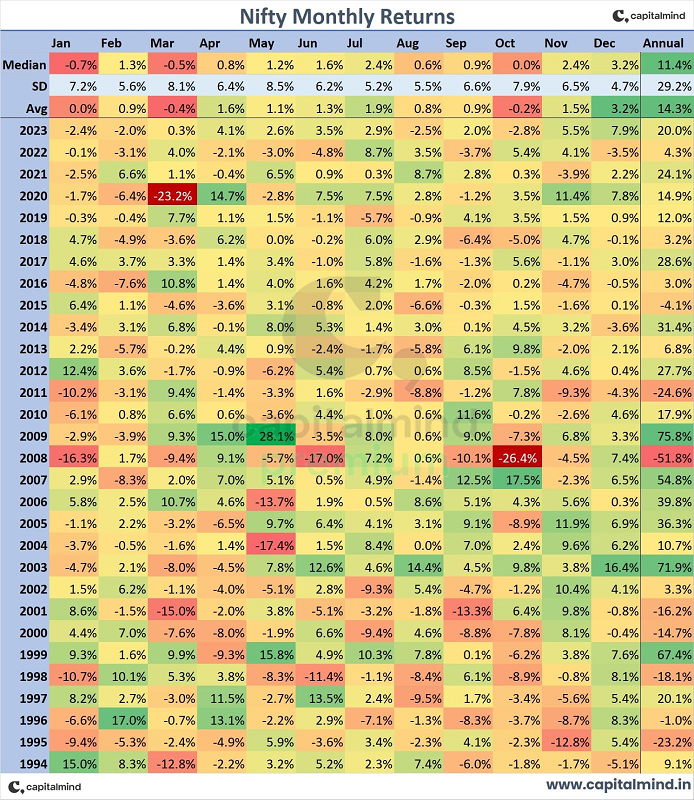

Before that, let me share the images which led him to approach me.

For different investors, these images may evoke different emotions. Some may be proud of their investment selections, while others may be questioning their investment plan. Some investors may still be waiting for the markets to fall, while others could be fully invested in equity.

Whichever side you are on, the below questions will help you design or review your investment portfolio and create something good for you. These questions are for you to reflect upon and find answers to. I have only comments to make and opinion on the better way to work out the portfolio.

How to Review your Investment Portfolio in 2024?

Question 1 – WHY did you invest in the first place ?

Were there some goals or you did it for fun and now when you have made money, you are thinking of investing more? Or was it because of FOMO (Fear of Missing Out).

See, even if you are calling your goal “Wealth Creation” as you have achieved all other important goals already, then also its fine, as goals only lead to some Investment strategy and help in selection of suitable Investments.

Goals only put pressure on you to be averse to risk or take more risk, depending on how sensitive it is to achieve the same. Goals only will give direction to your Money management and put responsibility on you, to be disciplined enough with your finances.

Without Goals everything is haphazard and direction less. You tend to invest in anything and everything which may have a potential to make money ”fast”. You do not pay heed to the risk value as that is not visible these days.

Know more: How to achieve financial goals ?

Question 2 – When did you invest ?

If it was last year only…then it’s too early to do a detailed Investment portfolio review. Just be true to yourself with the reasons behind Investments, as I mentioned in question 1.

If it was after or during 2020 i.e. after or during covid fall…there is a lot to be seen by you. You are under the wrong impression as to how markets work. Until you have participated in ups, downs and slowdowns, and stick to your plan, you are nowhere near the definition of a good investor.

In the last few years lots of new investors have entered the equity markets, which are good for the markets but may not be that good for the new investors who consider this place to make fast money. With so many Fintech platforms it is easy for new and young investors to jump from Regular to Direct, MF to Stocks, Listed to Unlisted stocks. (Also Read : Did your Mutual fund deliver 100x return?)

Nowadays, under the lure of making money fast, they do not shy from investing in alternative investments like Cryptos, Unlisted shares, Angel Investing, Fractional Real estate etc. without considering its impact on their long term portfolio and above all on the Investment habits.

Know about: 21 Good Money Habits for a Great Financial Life

If you are among those, it’s time to be cautious, and make an investment portfolio with proper Financial planning approach. Only seasonal investors who have participated in different market cycles understand the risk and return tradeoff.

Question 3 – What is your Investment Strategy?

Assuming that you are operating with some goals and that too long term, and have been investing for quite some years now, then it’s wise to do the Investment portfolio review.

What is the Asset Allocation? Review the Weightages of different Asset classes and Rebalance it to the decided one. Don’t go overboard on equity, after experiencing the last year run up. Also, don’t reduce the allocation expecting the markets to fall, unless your goals are 2-3 years away. Stick to the process.

Review the Diversification. Check for Stocks Overlap, Fund categories spread, Market cap wise fund allocation, and rebalance this side too. There has to be a proper mix of different fund strategies and market caps as per the risk profile. These days investors are over allocated on small caps, after seeing the last year numbers. Avoid doing the same.

If the goal is far, do not design your portfolio based on 2023 performance. One year should never define your long term portfolio mix. (Read: Why Average Investors earn below Average Returns?)

What about the debt allocation? Hope you have not shunned the debt completely from your Investment Portfolio. Even in the new tax rules, the debt fund can play a decent role. However, depending on your Risk understanding, you may consider these Alternatives too if it suits your goals.

Gold requires Crises to perform well. The way things are moving, currently it seems crises will keep coming in one form or another. So do consider allocating 5-10% of allocation in gold. And also like equity don’t consider the near term performance to continue for long.

And even try doing 5-10% of International diversification too, even if you are bullish on the Indian Economy.

Question 4 – Who is your Advisor ?

Are you a Do it yourself Investor or do you have a Financial advisor to advise you on your Investment management. If you do it yourself, then again who do you take advice from or do you do your own research?

Your Investment portfolio should be personalized to your needs, risk profile and goals.

If you have a professional advisor for this work, just make sure that the person is SEBI registered.

Question 5 – How do you Invest ?

With ‘how’ i do not mean the way you invest – Online/Offline…but the process you follow which guides you in your Investment journey. Do you have any investment plan in place or do you invest as and when you feel like? Do you do SIP/STP or do you feel that you can time the market?

Are you an equity investor for the long term (7/10+ years) or do you think long term as 1 or 2 years?

Do it yourself investors have to do deep research. You just can’t follow 1-2 blogs or some Instagram and YouTube channels and feel that you are done with the research. Its the question of your hard earned money.

There has to be an investment plan in place, which will become the basis to review the investment portfolio every year. There has to be some basis of an investment plan, which is a part of a broad financial plan.

Conclusion:

There is no straightforward answer, if you are in the right portfolio or not. Only the Recent returns cannot become a basis of designing the Investment Portfolio. Your investments cannot be considered as good, only if they are generating high returns.

In fact, High and Low returns are always in Comparison. A good portfolio has many components to be looked into, like Low correlation between securities, No or lesser stocks overlap, Diversification in strategies, Goal based, Proper Asset Allocation etc.

The Ongoing Run up and euphoria going on in the market is creating a very wrong impression of investments in the minds of new investors. It is important to be cautious and follow a structured approach, this is what I can conclude.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.