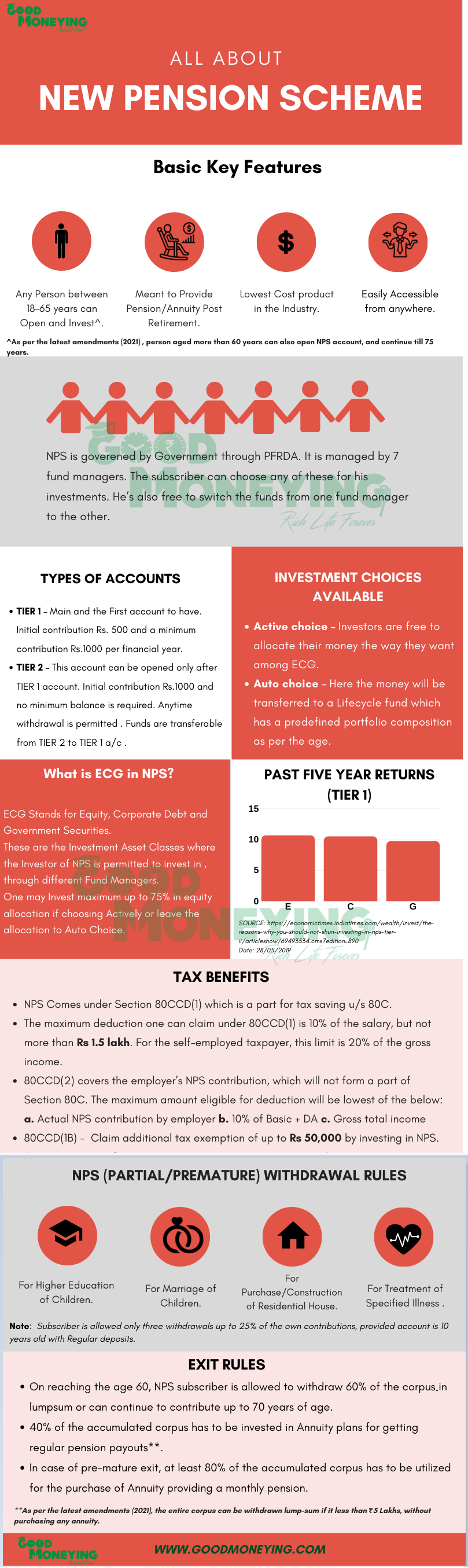

NPS is no longer an alien product to Investors. With the tax benefit u/s 80CCD, it is one of the sought after product, especially for tax saving. Though Investors have concerns on the taxation on maturity, the feature of 60% tax-free withdrawal at maturity, has taken care of the most part of worry. (Read: NPS withdrawal rules?)

Check the NPS Infographic at the end of the Post to have a detailed understanding of the Product.

But while opening of NPS account two doubts has always come up as to which fund manager to choose among the 7 fund managers and also which investment choice to opt for between active or auto investment choice.

NPS is a very long term product, meant for Retirement Planning, and what is generally said is that longer the horizon higher should be the equity allocation to earn more in the long term.

Earlier the auto investment choice did not have high equity allocation or aggressive portfolio, so whenever a young person in his late twenties or early thirties ask on what to chose, my answer had always been to go with active choice of 50% E, 25% C, and 25% G, and leave the money as it is in this allocation until the maturity. (Read: what is E C G in NPS?)

But now with the coming up of aggressive allocation in auto life cycle fund where 75% can be into equity up to 35 years of age, it is natural to attract eyeballs of many investors.

But, is it really so attractive that everyone having a longer horizon, say 15 years or more, should put their money into aggressive allocation or should one still consider the active choice and chose the allocation as per the risk profile and requirement?

Now it is also possible to start SIP in NPS. Click here to know how to set up SIP in NPS online using the D-Remit Facility.

Recently one of my client in his early 30s while opening enps account, asked me the same question as to should he go with aggressive auto allocation with 75% of equity allocation or go with an active choice where the choice of allocation is personal. This made me do some calculations to figure out the end result, to help him take the decision. But I otherwise do not want any person to choose between active and auto choice based on the numbers alone, and one should have the following considerations before taking the final decision.

I otherwise do not want any person to choose between active and auto choice based on the numbers alone, and one should have the following considerations before taking the final decision.

( Read more: SWP in NPS – Systematic Lump Sum Withdrawal in New pension Scheme )

Considerations before choosing between active or auto investment choice in nps investment

- NPS allocation should be a part of your overall investment allocation. If you are conservatively allocated in your otherwise portfolio, then you should not be aggressive or moderate in NPS allocation.

- You should know that the Auto choice in NPS is a lifecycle fund, where the allocation keeps on changing with the age. Even in aggressive allocation 75% of equity exposure remains only till 35 years of age and keeps reducing in later years.

- The Equity allocation will be into Index kind of portfolio, and thus the returns would more or less replicate the Broad market Index. Thus you should not compare it with the actively managed mutual funds as generally available in the market.

- The Investment choice should not depend on your age. If you are young, that does not mean you should go aggressive in Investments and if you are old that also does not in any way means that you should go conservative. It all depends on your Risk tolerance and other aspects of asset allocation.

Before sharing with you the calculations and Results, let me give you a brief on how these active or auto investment choice in NPS works.

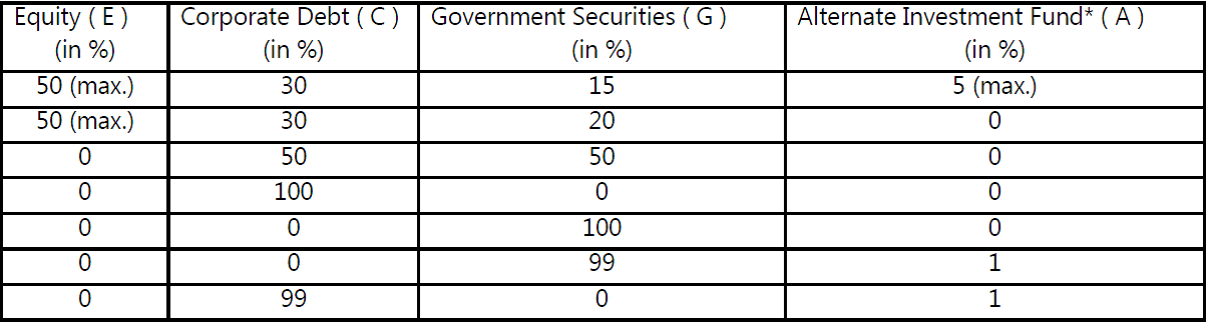

Active Investment Choice: Under this option, Investor can decide his own Investment allocation in Equity(E), Corporate Bonds ( C ), and Government Securities (G). There is one new addition to this choice which is an Alternative asset (A), where one can allocate a maximum of 5% of total investments.

Under “A” choice, Investment in SEBI Regulated ‘Alternative Investment Funds’ AIF (Category I and Category II only) as defined under the SEBI (Alternative Investment Fund) Regulations 2012 is permitted. Read a Detailed Article on AIFs here.

There’s one further restriction in the active choice i.e. a maximum of 50% can be allocated in Equity (E) category. However in case of C and G, one is at liberty to even have 100% in a C or G

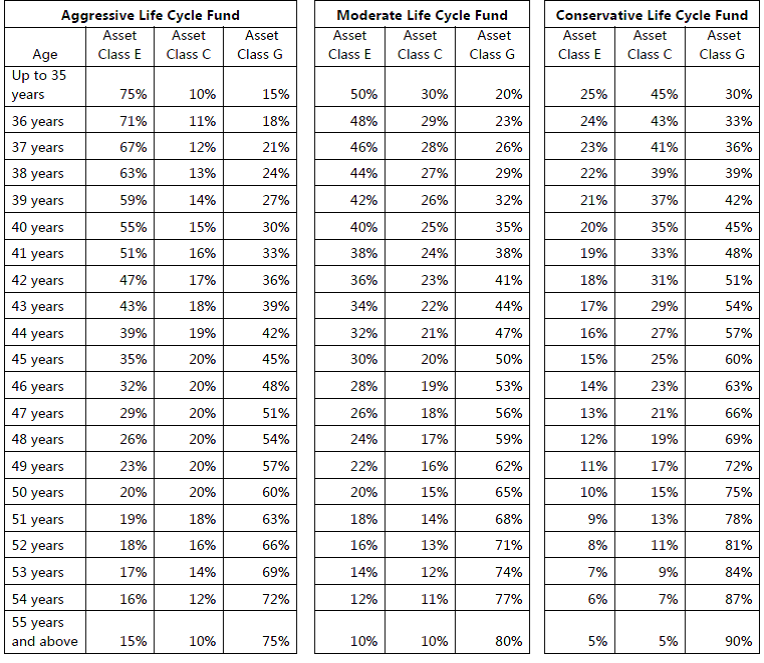

Auto choice: In Auto choice, which is also known as Lifecycle fund, there are further 3 choices where there is a predefined spread of funds in E C and G, and which keep changing every year as investor ages.

Below is the NPS Investment Auto choice table

Earlier there was only Moderate Lifecycle fund, but then in 2017, the other 2 choices have been provided.

The announcement of this aggressive choice has made young and market savvy investors to think if they should opt for this in the active or auto investment choice, which led me to do some calculations to help them made this choice.

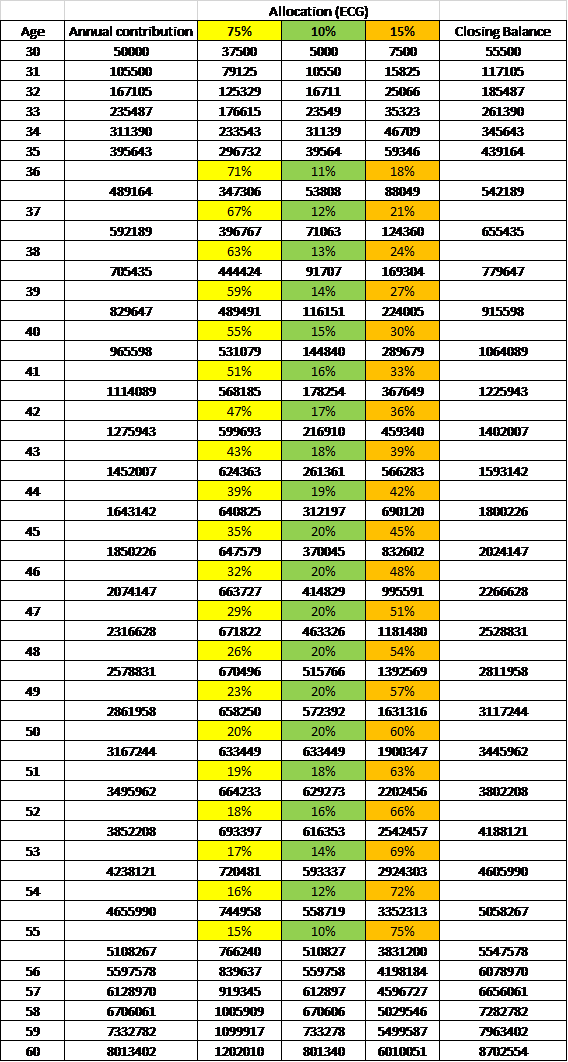

I assumed that the Investor’s age is 30 years and he will be investing Rs 50000 per annum till 60 years of age. Since he has 30 years of investment time horizon and his otherwise Investment allocation is also 60% E and 40% D, so either he can go with the Aggressive allocation with 75% of equity up to 35 years of age or active choice where he can chose 50% of equity and rest equally divided into C and G, and continue this allocation till Retirement.

I further assumed the Equity Returns to be 12% per annum and debt (C or G) to be 8%.

This comes up to an annual return of 10% (50%*12% + 50%*8%) in the case of auto choice, which has resulted in the maturity amount to Rs 90.47 lakh after 30 years.

Whereas, in the case of aggressive choice, the maturity value comes out to be Rs 81.26 lakh.

This clearly shows that keeping money in aggressive option in auto choice may result in Rs 10 lakh lesser than the active choice with aggressive allocation.

NPS Investment Subscribers can change between Auto and active choice

There is one more option which market savvy investors may like to exercise. NPS investment subscribers can now switch between active or auto Investment choice or between different allocations in active choice. This option can be exercised twice a year. So one may start with an aggressive auto choice for first few years and later on say by 41 years of age one may move to active choice with higher equity allocation.

But do keep in mind that you should not keep playing with the choices, which means that you should not switch your holdings too frequently. This is due to 2 reasons; one is that every switch will cost you some amount, which may not be that high but cost is cost. And the second reason is that this may result in you into trying to time the market which itself is not possible and you will lose the discipline of Investment.

If you want to make the most of your NPS Investment, better to decide on the allocation at the start and stick to it for long. The Best option is to have a single allocation for a lifetime, and another good option is to Review the allocation every 10 years.

What are your views on selecting of active or auto Investment choice? Kindly share in the comments section.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

Best option for a 30Y subscriber(example chosen in the article) to create corpus for retirement would be to move from aggressive to active choice when he is at 41Y age.

It’s at 41y that aggressive equity % becomes lower than active in terms of Equity Contribution. For a long term investor, who still has 19years remaining for retirement, making a switch from aggressive-lifecycle to Active fund at this juncture will get best results even better than the 2 options you have computed and is considerably risk-free because as the person is closing towards retirement, the corpus will be 50% invested into C+G.

Will love to hear your comments on this.

Is it possible to switch between Aggressive/Moderate and Conservative? If yes, how many switch allowed per year?

What is switch fee/cost per switch?

Suppose I switch from aggressive fund(auto choice) to active choice at age 41. Can the entire accumulated fund get 50% equity allocation or just the amount invested from 42nd year onwards? What can be approximate cost for that switch?

Entire fund will get the 50% equity allocation

Hi Manikaran would like to hear on the comment made by Anubhav Agrawal.

Yes Gaurav. If you want maximum equity exposure possible in NPS always, then what Anubhav has written is correct.

i am 53 yrs and entering NPS for first time with 2L. considering MY RETIREMENT after 7 yrs at the age of 60 yrs, what would you suggest – to go for Active or Auto mode ?

If active then what should be the ideal Ratio at my age between Equity , Gilt & Debt in therms of % ?

here you financial Plan will play a key role. What is your risk profile, where your other investments are lying, what are your other goals etc. all need to be considered.

Dear Sir,

I have opened an NPS account and deposited some amount in auto-aggressive. I am now 36 years old.

So my asset allocation is 71%, 11% and 18%. But if I see the gain/loss option of NPS balance it is showing loss value.

could you please advice me which option is better to switch from auto aggressive to other. I dont want to take any risk.

If you want to go conservative, better to move to active management and put the money 100% into debt options. But in short term you may see it also in losses.

Your calculation is not correct. At age of 42, 17% allocation of 12,75,943 will be 2,16,910 (not 1,01,948 ).

At age of 60, the amount would be 87,02,554 but yours came out to be 81,26,108.

Also, considering an equal contribution of 50% in Class E and Class (C+G), the amount would be 88,14,741 at the age of 60 but you have mentioned around 90.47L.

So, the difference would be around 1,12,187.

After age of 42, as equity contribution is less than 50% in auto-aggressive, so this factor affects the final amount. But, considering we can have a lesser return in equity as well then auto-aggressive choice would be a safer option to go with.

Also, equity return should be calculated on long term ( consider 10 years) as the short term may have very less returns, so one should lower down his/her equity contribution at age of 50 to minimize volatility effect of the market on returns at retirement. Considering these cases and as the difference is low, I would prefer to select auto-aggressive option in NPS.

Please check your calculation again and update the article.

I have APY and NPS Tire 1 and contribution to both APY 6500/- and NPS Tire 1 2500/-, NPS Tire 1 ICICI, can which Fund manger is best performer to switch.

Dear Sir,

My age is 32 now Which one is better option for me

At 23 years of age, how should the nps investment planning be done?

if you are an Aggressive investor, you may go for the active choice with an higher allocation to equity, say around 70% and if you are a conservative one,you may lower the equity allocation, which would reduce the risk as well.

If you do not know your investment style then you could go with the auto option in which the equity allocation gets decreased according to age.

I am unable to final whether active choice is best or auto choice is best in NPS even after reaing this article. can you let me know which has more advantages

Additional Query: I am 29 now. I will be investing 50000 per annum

if you are an Aggressive investor, you may go for the active choice with an higher allocation to equity, say around 70% and if you are a conservative one,you may lower the equity allocation, which would reduce the risk as well.

If you do not know your investment style and do not have any adviser by your side then, it would be better to go with the auto option in which the equity allocation gets decreased according to age.

I am 29 now and i would like to open NPS and contribute 50,000/- per annum to save tax. Now i am stuck and confused between Active choice or Auto choice option. I would like to know which one is better to select in my case

if you are an Aggressive investor, you may go for the active choice with an higher allocation to equity, say around 70% and if you are a conservative one,you may lower the equity allocation, which would reduce the risk as well.

If you do not know your investment style and do not have any adviser by your side then, it would be better to go with the auto option in which the equity allocation gets decreased according to age.

NPS allocation

what would be best choice for NPS

i am in early 40 so whci one i should choose in NPS

if you are an Aggressive investor, you may go for the active choice with an higher allocation to equity, say around 60-70% and if you are a conservative one,you may lower the equity allocation, which would reduce the risk as well.

If you do not know your investment style and do not have any adviser by your side then, it would be better to go with the auto option in which the equity allocation gets decreased according to age.

what would be best choice for NPS

i am in early 40 so whci one i should choose in NPS

if you are an Aggressive investor, you may go for the active choice with an higher allocation to equity, say around 60-70% and if you are a conservative one,you may lower the equity allocation, which would reduce the risk as well.

If you do not know your investment style and do not have any adviser by your side then, it would be better to go with the auto option in which the equity allocation gets decreased according to age.

MY AGE IS 38 AND WANT TO OPEN NPS. WHAT WILL BE SELECT ACTIVE OR AUTO, PLZ SUGGEST

if you are an Aggressive investor, you may go for the active choice with an higher allocation to equity, say around 60-70% and if you are a conservative one,you may lower the equity allocation, which would reduce the risk as well.

If you do not know your investment style and do not have any adviser by your side then, it would be better to go with the auto option in which the equity allocation gets decreased according to age.

NPS investment.. Selection of Auto or Active .. If Auto Which one is best E or C or G

if you are an Aggressive investor, you may go for the active choice with an higher allocation to equity, say around 60-70% and if you are a conservative one,you may lower the equity allocation, which would reduce the risk as well.

If you do not know your investment style and do not have any adviser by your side then, it would be better to go with the auto option in which the equity allocation gets decreased according to age.

I WANT TO INVENT IN NPS. I WANT TO KNOW WHICH ONE IS BETTER AUTO OR ACTIVE

if you are an Aggressive investor, you may go for the active choice with a higher allocation to equity, say around 60-70% and if you are a conservative one, you may lower the equity allocation, which would reduce the risk as well.

If you do not know your investment style and do not have any adviser by your side then, it would be better to go with the auto option in which the equity allocation gets decreased according to age.

In NPS, what % can I invest in equity as I am 58 year old

if you are an Aggressive investor, you may go for the active choice with a higher allocation to equity, say around 60-70% and if you are a conservative one, you may lower the equity allocation, which would reduce the risk as well.

If you do not know your risk appetite and do not have any adviser by your side then, it would be better to go with the auto option in which the equity allocation gets decreased according to age.

sir my age is 48 and i dont have any market expert i dont know which option to choose from active or auto in nps

if you are an aggressive investor, you may go for the active choice with a higher allocation to equity, say around 60-70% and if you are a conservative one, you may lower the equity allocation, which would reduce the risk as well.

If you do not know your risk appetite and do not have any adviser by your side then, it would be better to go with the auto option in which the equity allocation gets decreased according to age.

as u have the shown the calculation for auto choice with aggressive option. and u are telling u did calculation for active mode.

Sir, I am applying for NPS but I am confused what choice to choose Auto or Active. I want to understand in detail

If you are an aggressive investor, you may go for the active choice with a higher allocation to equity, say around 60-70% and if you are a conservative one, you may lower the equity allocation, which would reduce the risk as well.

If you do not know your risk appetite and do not have any financial planner by your side then, it would be better to go with the auto option in which the equity allocation gets decreased according to age.

My age is 24 years, and i want to invest in NPS but i don’t have any knowledge of market so is it a good option to invest in Auto+aggressive or should i go for auto+moderate option

It depends upon your Risk Profile and personal choices. Higher allocation towards equity has the potential to generate higher returns in longer-term but it comes with a higher degree of risk as well. If you are comfortable with the volatility, you may consider a higher allocation towards equity.

Hi Im new to NPS

Just want to Auto choice or aCtive choice which is better and what is lifecycle in auto choice

In Auto Choice, life cycle fund the equity allocation decreases as per the investor’s age. There are three choices within the life cycle funds. Aggressive, Moderate, and Conservative. if the investor is below 35 years, the allocation towards equity is 75%, 50%, and 25% respectively in Aggressive, Moderate, and Conservative Life Cycle Funds, which decreases as the investor ages.

Now as far as the choice is concerned, you may go for the active choice with a higher allocation to equity, say around 60-70%, if you are an aggressive investor and if you are a conservative one, you may lower the equity allocation, which would reduce the risk as well.

If you do not know your risk appetite and do not have any financial planner by your side then, it would be better to go with the auto option in which the equity allocation gets decreased according to age, as explained above.

how much is the cost for switch or changing allocations.

You are allowed to change the Scheme preference in NPS twice in a financial year. Only transaction charges would be applicable.

Which asset allocation is best in nps, E,C,G or A

E, C, G, and A are different asset classes in which the fund manager allocates the money in the asset allocation chosen by you. Now there are two choices- Auto Allocation and Active allocation. In the Auto allocation, the Equity exposure goes down with age, and in Active Allocation, you have the option to choose the exposure to each asset class as per your preference.

The choice depends upon your Risk Profile. If you are an aggressive investor, you may go for the active choice with a higher allocation to equity, say around 60-70% and if you are a conservative one, you may lower the equity allocation, which would reduce the risk as well.

If you do not know your risk appetite and do not have any financial planner by your side then, it would be better to go with the auto option.

I am 51 year age. Would like to go for auto choice. Which life cycle I have to invest ?

It depends upon your Risk profile and the volatility you are comfortable gauging in your investment portfolio.

My age is 37 started corporate nps it is first month planning to contribute 10000 monthly. I took autochoice option should I change scheme to Active choice with 75-E, 15-C, 10-G. Let me know percentage if you suggest me to change to active choice

Hi Kiran,

It depends upon your risk profile, how much volatility are you comfortable within your investment portfolio. If you are an aggressive investor, you may go for the active choice with a higher allocation to equity (as mentioned by you) and if you are a conservative one, you may lower the equity allocation, which would reduce the risk as well.

If you do not know your investment style and risk profile then, it would be better to go with the auto option in which the equity allocation automatically gets decreased according to age.

I am 53 year old. Starting to invest in NPS I think its too late to begin so which one will you prefer auto choice or active choice. Can’t take too much risk.

Hello Mr. Ramprakash,

In our opinion, the auto choice would suit you as in this the allocation is to equity comes down according to the age. However, if you do not want to take any risk, you can go for active choice with 0% Equity allocation.

I am 57 year old. I have contributory retirement scheme of my organization where annual return is approx. 8%. will it be beneficial to withdraw accumulated amount from my existing scheme and invest in NPS as lump sum and then continue with NPS. If yes, which will be better choice auto or active.

I want to change the scheme in NPS. Guide me which is best percentage combination of C ,G and E. I am 67 years old now .Joined NPS at the age of 64 years

From the asset allocation point of view, there are a lot of things which need to be considered like your risk tolerance, time frame , distribution , your other assets. Better is to be in touch with a financial planner.

However, from your age perspective, it is advisable to keep 70-80% of your corpus in debt funds like government securities or corporate bonds.