For the past few years, I have been observing that there’s a bit of similarity between LIC and Bollywood Khans. While Khans release their movies on specific festivals like Eid, Diwali, Christmas every year, LIC comes up with its new plan always at the start of the year. Not only this, most of the releases and policies, break the records of previous collections, due to high FAN following 🙂

Well, more collection doesn’t mean that it is good for everyone to invest in. One needs to be sure that it fits into the requirement and help in achieving goals.

This time also on 4th January 2016, LIC announced its new insurance Plan with the name LIC Jeevan labh. This is a Participating, non-linked insurance plan, with limited premium benefit features.

The launch of new plans in the last quarter of the Financial year and that too with full-page newspaper ads, clearly shows the marketing trick, to gain maximum attention, especially from those who seek to invest for tax saving. Though LIC ads say, “LIC hai to kahi aur kyo jaye?”, but does it make sense to invest in LIC Jeevan Labh? Let’s review the product first.

LIC Jeevan Labh – In Short

LIC Jeevan labh is a non linked, limited premium, with profit endowment assurance plan. The limited premium feature in this plan lets you chose among 3 variants of Policy terms, and the corresponding premium paying terms. Available Policy terms are 16, 21, and 25 years, and premium paying terms are 10, 15, and 16 respectively.

Once you decide on which policy term you want to invest in for, you will be intimated with the premium you have to pay, which further depends on the age of the person to be insured and the sum assured opted for.

You keep paying the premiums for defined premium paying term, and stay invested till policy term, then you will get maturity benefit as Sum assured plus all accrued reversionary bonuses and final additional bonus ( If any). Unfortunately if you die before completion of policy term, then your policy nominee will receive the Sum assured plus all accrued reversionary bonuses.

If your policy premium is 10% or less of the policy sum assured then your premiums are eligible to be claimed under section 80C benefit and also the maturity amount you get will be tax-free u/s 10(10)d.

LIC Jeevan Labh – Basic features

- Minimum Entry Age – 8 years

- Maximum Entry age – 59 years

- Maximum Maturity age – 75 years

- Minimum Sum assured – Rs 2 lakh

- Maximum Sum assured – No Limit

- Policy terms (Years) – 16, 21 and 25

- Premium Paying Terms (Years) – 10,15 and 16

LIC Jeevan Labh – Other additional Features

- This policy provides one optional rider as Accidental death and disability benefit, by payment of additional premium. If opted, the total basic sum assured on accidental death will get doubled and in case of permanent total disability (due to accident), all future premiums will be waived and sum assured equivalent amount will be distributed in 10 monthly installments.

- There’s also option for term insurance rider, which one opts for at the time of policy buying. This will increase the death benefit with the sum assured opted for, under term insurance rider.

- Loan facility is also available in this plan subject to few conditions.

- Discounts on Premiums are available on different Premium payment modes and on high sum assured.

LIC Jeevan Labh – Returns review

Let’s analyse the illustrations provided on the LIC website to figure out the tentative returns from LIC Jeevan labh. Since this is an endowment plan which invests only into debt instruments, so we can’t expect equity-like returns in this product. IRDA has also stipulated to show the illustrations with 4% and 8% returns.

On maturity, the insured will get the sum assured plus a simple reversionary bonus plus final additional bonus. Simple reversionary bonus is declared every year and depends on the corporation’s overall performance in that particular year. The bonus rate varies with different policies and terms with in the policy.

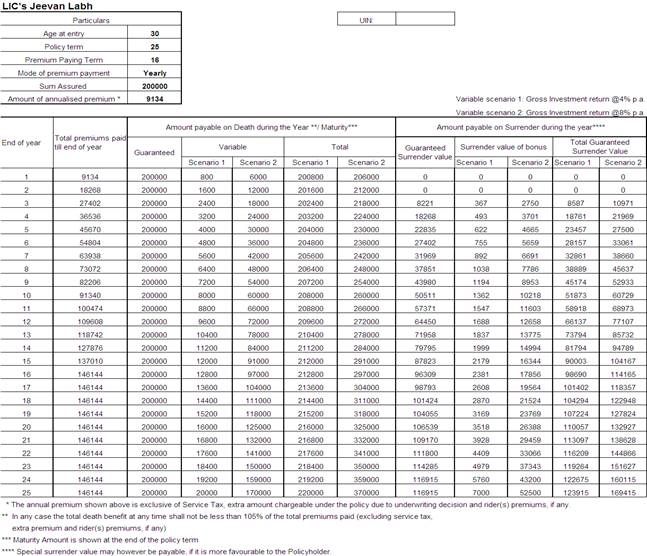

The above illustration is for 30 years old person, who opted for 25 years policy term with 16 years of Premium payment term. For sum assured Rs 2 lakh the premium comes out to be Rs 9134 (exclusive of service tax).

On Maturity, the policyholder is expected to get Rs 220000 (@4%) and Rs 370000 (@8%). Premium has to be paid for 16 years and the policy will be matured after 25 years. Calculating IRR as per the data, it comes out as 2.33% and 5.28% respectively. It will reduce further when Service tax is added to the Premium

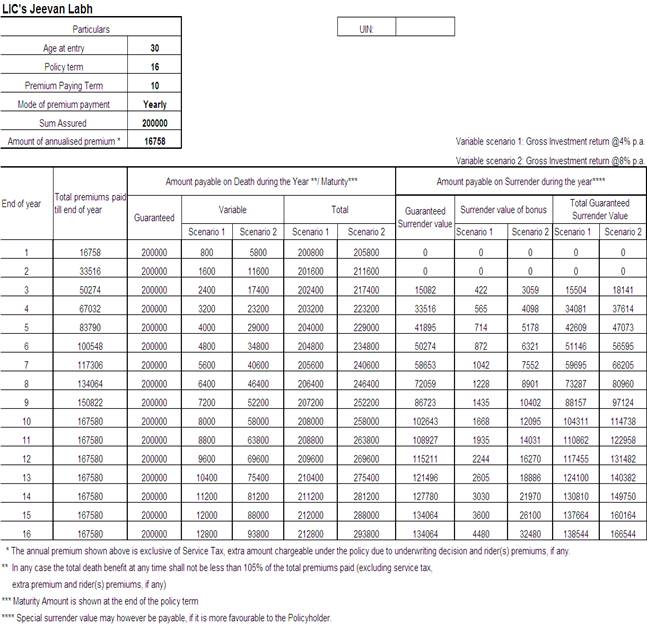

The above illustrations are for 30 years old, with 10 years premium paying term and 16 years policy term. IRR comes out to be as 2.08% (@4%) and 4.91% (@8%). Returns will further reduce when Service tax added to premiums.

The actual returns of the policy may vary. Even the previous bonus rates of LIC policies are better than shown in the illustrations. But still one should not expect much of difference, being a debt product.

LIC Jeevan Labh – Should you invest?

Well, first thing first, getting adequate insurance cover from an endowment policy will prove very costly to you. So you have to buy Term Insurance if you want to have good coverage. Thus, buying insurance through this product is out of the question here.

Looking at the expected returns, if you are happy with 5-6% of annualized returns then yes this policy is for you. But do remember that the return will be less for aged investors as the mortality costs will be high, but also returns will improve slightly for those who claim tax benefit u/s 80C.

Whether the policy work for you or not will depend on your age, your risk profile, your cash flow, your other investments and insurance coverage, your Required Asset Allocation, and goals targeted. There cannot be a simple yes or no to this. No product is good or bad, it’s the usage and fitting of that product into the financial plan which makes it useful.

On the face of it since it is a lock-in product, with no rebalancing feature and no control over managing the funds, with unnecessary insurance cost ( as term plans are already bought), so I advise not to invest just because it is from LIC. I have always been advising to keep Insurance and Investments separate, as I find the structure easy to manage.

Do the maths, understand it’s usefulness in your financial profile, look at your finances holistically, and then decide.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

Hi,

My age is 35 yrs, i do not have any life insurance policy, would u plz suggest me which one suggest i go for. I except good returns at the time of maturity. Can invest around 5k every month

You should not buy any Insurance Policy for investment. Keep Insurance and Investment separate.

LIC Jeevan Labh should i go for it

need some clearity

As per our information, Jeevan Labh Plan has been discontinued, please check.

Please tell me IRR of Anulised premium paid 23100 for 16 years after that 25 years no premium paid and completing 25 years I got maturity sum assured rs.500000 and + bonus…the policy is jivan labh… please tell me IRR

Hello Mr. Tanpure,

Considering the information you have provided and the latest bonus rates of LIC, the IRR of your Jeevan Labh Policy comes to around 6%. However, please note that it is just an indicative figure. Actual rate may vary.

Sir yea of 2000 we bought leveen labha 936 table policy SA 2500000 term 25 । How much expectations matiturity amount? Please reply me,