Many health insurance companies are offering discount on purchase and renewal of their policies, if insured pays 2 years premium in one go. Apollo Munich health insurance offers health insurance discount of 7.5% per year and Max bupa also offers discount of 10% is someone opts to pay for 2 years.

Where it is clear that why Companies offers Health Insurance discount, as they get the lumpsum amount and confirmation that policyholder will stay with them for next 2 years, but does it make sense for insured to pay in one go. Lets understand the pros and cons for insured.

Benefits of Health Insurance discount – Insurer’s View

Insurer is offering this health insurance discount benefits by pitching 2 advantages:

- It gives a monetary benefit as you will be paying less in total. For e.g The premium for 1 year comes to be Rs 10000/- and if paid for 2 years then the premium would be Rs 18500/-. It’s a clear benefit of Rs 1500/-

- Second benefit as per insurer is that customer gets protection from next year increase in premium (if any). As in above example, if next year company increases the premium to Rs 11000/- so you would have to shell Rs 11000 for next year.

Health Insurance discount – Mathematical comparison

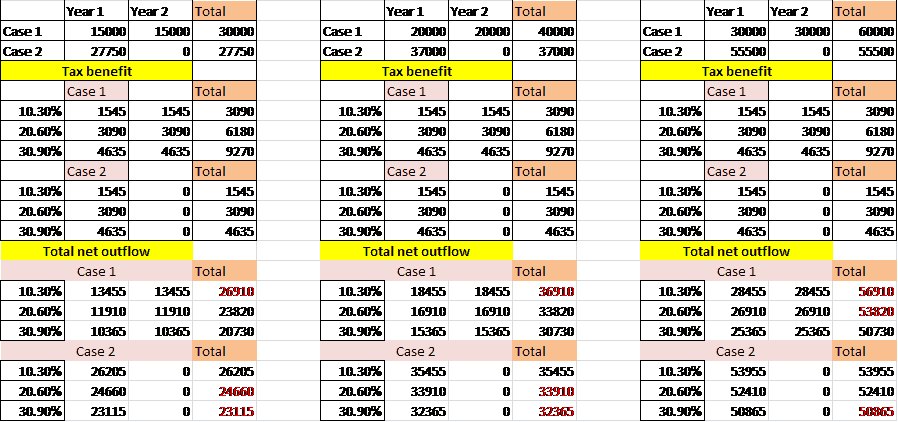

Though it is very much clear that monetary benefit is there in terms of discount, but one has to look at this benefit from tax benefit angle also. We all know that health insurance premium comes under tax deduction u/s 80D of income tax act. Paying premium for 2 years, results in forgetting with the tax benefit next year. So what difference does it make from net outflow point of view? Is it beneficial taking discount this year and ignoring the tax benefit next year or is it better to pay the premiums separately for each year and ignoring the health insurance renewal discount. I have done some mathematics over this specifically for Apollo Munich Health insurance discount offering of 7.5%, which I believe readers will also take benefit from. Below are the details:

Case 1: Premium paid Yearly

Case 2: Premium paid for 2 years and availing discount of 7.5%

I have done 3 calculations with Premium rates as Rs 15000/- , Rs 20000/- and Rs 30000/-

The tax benefit in case of “case 2” is limited to only on Rs 15000/- as per section 80D of income tax act.

The above calculations make it very clear that even after availing health insurance renewal discount for 2 years, there’s hardly any difference in the net outflow of money if some pays it separately for different years.

Health Insurance discount – What should insured do?

From monetary point of view as shown in the above calculations it is not making much of a difference in the net cash outflow (after considering discount and Tax benefit), in fact in some cases the net outflow is more after considering discount then it is without discount. So, this tells that paying later is better. Moreover if you consider take time value of money then also paying later will be better.

Regarding the second benefit which insurance company offers of protection from the rise in premium doesn’t matter much, as rise in premium would be anyone’s guess and no one can predict this in advance

Paying Year on Year and ignoring health insurance discount will also keep the portability window open in case due to some reason you want to port out your policy to some other health insurance company.

So my take is Ignore any Health Insurance discount and keep paying the policy premium separately year on year.

If you agree with my views and like this article on Health Insurance discount then do share with your friends.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.