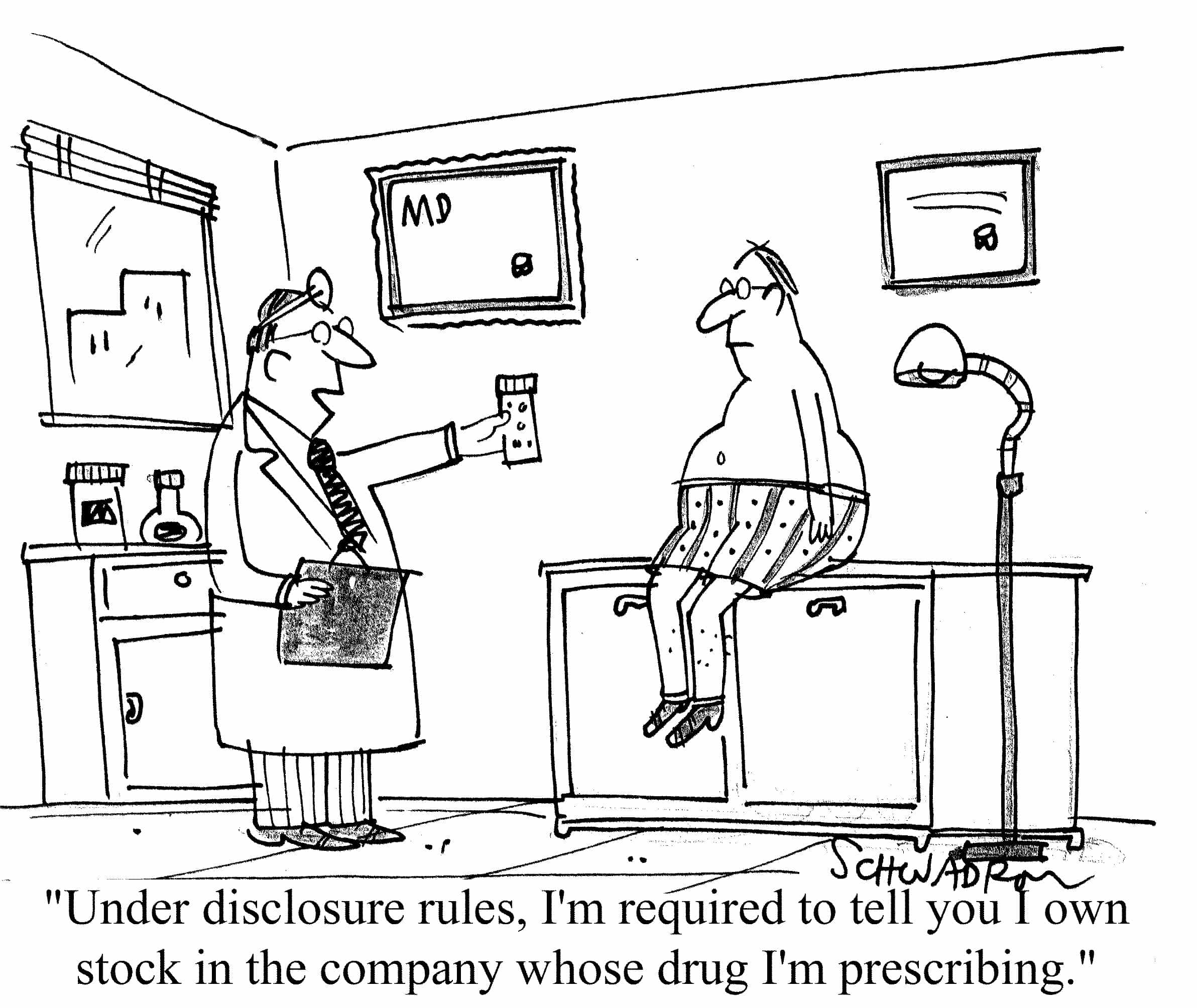

Conflict of interest is one of the major reasons of mis-selling; this is what Indian financial Regulators feel. This is the reason they come up with new regulations every now and then to protect the interest of investors.

Regulations have impacted not only at Product level by reducing the commissions, but also at the advice level where regulator wants to be sure that Investors are being provided with genuine process oriented advice with proper understanding of risk and requirements.

No Industry is devoid of Conflict of interest. You will find a pitch for a particular brand’s TV, Mobile etc. when you visit any electronic store, unless you ask for a specific brand. The school where your kids studies, itself sells or directs parents to a specific shop to purchase uniforms or books.

Doctor advises you to get your diagnostic tests done from a particular lab, your chartered accountant tells you to buy insurance policy of a specific company while advising you on Tax saving investments, property dealer wants to sell a specific Builder’s flat, and bankers want to sell investment products along with Loan etc.

There are many such examples that you find in your day to day dealing with sellers who are acting as advisers or advisers who ultimately sells.

Things have been so complex that sometimes it is not possible to separate out conflict of Interest from the advice. But what you can do is to accept the conflict and not let that conflict harm you in any way by empowering yourself with knowledge.

Conflict of interest is harmful, when you are left with no choice but to go ahead with the transaction with no option of leaving it in between.

Wikipedia says – A conflict of interest is a situation in which a person or organization is involved in multiple interest (financial, emotional or otherwise) one of which could possibly corrupt the motivation of individual or organization.

Conflict comes when there are 2 interests involve and your secondary interest is corrupting the primary interest. In all the above cases if the interest which could be the cut from diagnostic lab, commission from insurance, profits from selling uniform and books etc. is the main motivation behind the advice then this is affecting the primary interest which is welfare of patients, customers and client and thus conflict is there.

Financial investments sector has always earned its income from the commission inherently designed in the product itself. Unlike Doctors and Chartered accountants, financial distributors rarely charge fee and thus commissions have been part of their major earnings.

It is only after Sub Prime Fiasco that Financial Regulators worldwide realize that financial products should not be sold, it should be advised and bought with a proper reason. And thus to reduce the conflict lying in advice and sale, it abolishes the entry load in Mutual funds and tells advisers to charge fee for services.

Since then Regulator has been on spree of announcing measures like capping the commissions, making investor awareness sessions compulsory for AMCs, announcing the direct plans and recent announcement of regulating the Investment advisers.

SEBI has clear definition of Investment advisers and financial planning comes under that definition. After the announcements of Regulations no Adviser (Individual/corporate) can use the word “Investment adviser” without getting Registered with the Regulator.

Those who are truly into investment advice have been registered and providing advice to clients under regulatory framework by following the process specifically lay down by Regulator with regular stringent audits.

Those who are registered with SEBI have to compulsorily disclose the conflict of interests if any before serving the client. They have to do a process based risk profiling of the client and have to conform the suitability of the advice which SEBI may audit anytime.

But there are many who still have not registered themselves, there are many agents, distributors, product sellers who call themselves as Investment advisers and investors are falling prey to the sales pitches.

People ask questions on TV shows, Newspapers, Blogs and take advice , but that is a general advice and is not regulated one. True advice would only be possible when you directly engage with the blogger or the writer who should be registered with SEBI as Investment adviser.

Trust begins to emerge when we have a sense that another person or organization is driven by things other than their own self gain. And I believe that if the conflicts have been disclosed upfront, with advice and execution separated and optional on the part of Investor, there lies no question of biased advice or advice driven by secondary interest.

So one thing is clear, that if you are looking for advice related to your overall financial wellness and planning, you should consult only SEBI Regulated Investment adviser, but if you have your own criteria of selecting products and just want to invest through a distributor than you don’t require any adviser.

If you are kind of “as and when” person with no clear goals, always looking for new products to invest in, afraid of investing through a process, feels that when things are available for free then why to pay “FEE”, in that case you yourself are exposing yourself to misselling and you cannot blame any product seller or regulator for any wrong happens to you.

So in nutshell there are majorly 3 ways you can avoid the conflict of interest harm you.

1. You should know if you need advice or just product

2. You should directly ask the conflict of interest from the seller/adviser and terms and conditions of the engagement and decide on transparency level of the person concerned.

3. If you are dealing with an adviser then the person or organization needs to be registered with SEBI.

SEBI has clearly demarcated between sellers and advisers. Now it is up to the buyer of the product or service to understand whom he is dealing with and has the necessary steps being taken by the service provider to protect the interest of the investor.

This article was originally written by me for the Dalal Times. Please find the original Piece here

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

I thank you for your self-less service. I want your opinion about Atal Pension Yojana. As per the scheme, the subscriber would be eligible for Rs.5000 as monthly pension from the date he complete 60 years. My son is 31 years and he has to contribute Rs.632 p.m. for 29 years to Rs.5000 pension. Now, if he opens a Recurring Deposit A/c in a Bank at the rate of 8.25% p a for 29 years, the maturity amount comes to Rs.9,06,000. And if he keeps it as Fixed Deposit for maximum period with monthly interest, he is sure to get more than Rs.6000 p.m.

Yes Mr Raju you have calculated it right. Just select the right product which makes the accumulation of corpus tax efficient.

ATAL Pension yojana is launched keeping in mind the “No social security” cover available to Indians, and such schemes are for those who can’t do such maths 🙂

All the recent schemes launched by PM for life insurance, accident insurance and now pension is too create a contributory safety net for EWS section.

i have a potfolio of one million in value, my financial planner is married to my sister who is my beneficiary, so my financial planner is indirectly my beneficiary. I have not spoken to him or my sister in two years, i am under alot of stress because of it, I have no other family i am single no kids i am alone. I need someone i can go to besides my planner to ask questions, get second opinion on the moves hes made with my money. Who do i go too? Ineeded money to buy a truck two years ago, he told me to go get a loan even tho i had a million bucks invested with him. two years later and i never got my truck. I am on SSDI so i have a disability. I also have about 600,000$ in real esate. They want me to die, they would rather have the money than me any day. Isnt this a conflict of intrest? There are other things i could tell but , who do i talk to?

Hi Robert,

Your concerns are genuine. But we are based out of India and even if we are willing, we cannot help you. Please visit the below link. It is the website of an association of Financial Advisors in America and has a very good reputation. Please consult them, they may surely help you.

https://www.napfa.org/