Filing Income Tax Returns is one of the most important tasks to be completed in a financial year. Be it- salaried individuals, business firms, or companies all are required to file returns.

It is the duty of every taxpayer to file Income Tax Returns before the due date even if you have paid all your taxes or your income is below the exemption limits.

Income tax Return filing has many benefits and non-filing attracts various penalties. In some cases, it is mandatory to file ITR as well. Read this article for details.

The first step in filing the tax return correctly would be the selection of the appropriate Income Tax Return Form.

The Central Board of Direct Taxes (CBDT) on 22/12/2023 notified the new ITR Forms for AY 2024 – 25, where assesses have to report the income earned in the Financial Year 2023-24.

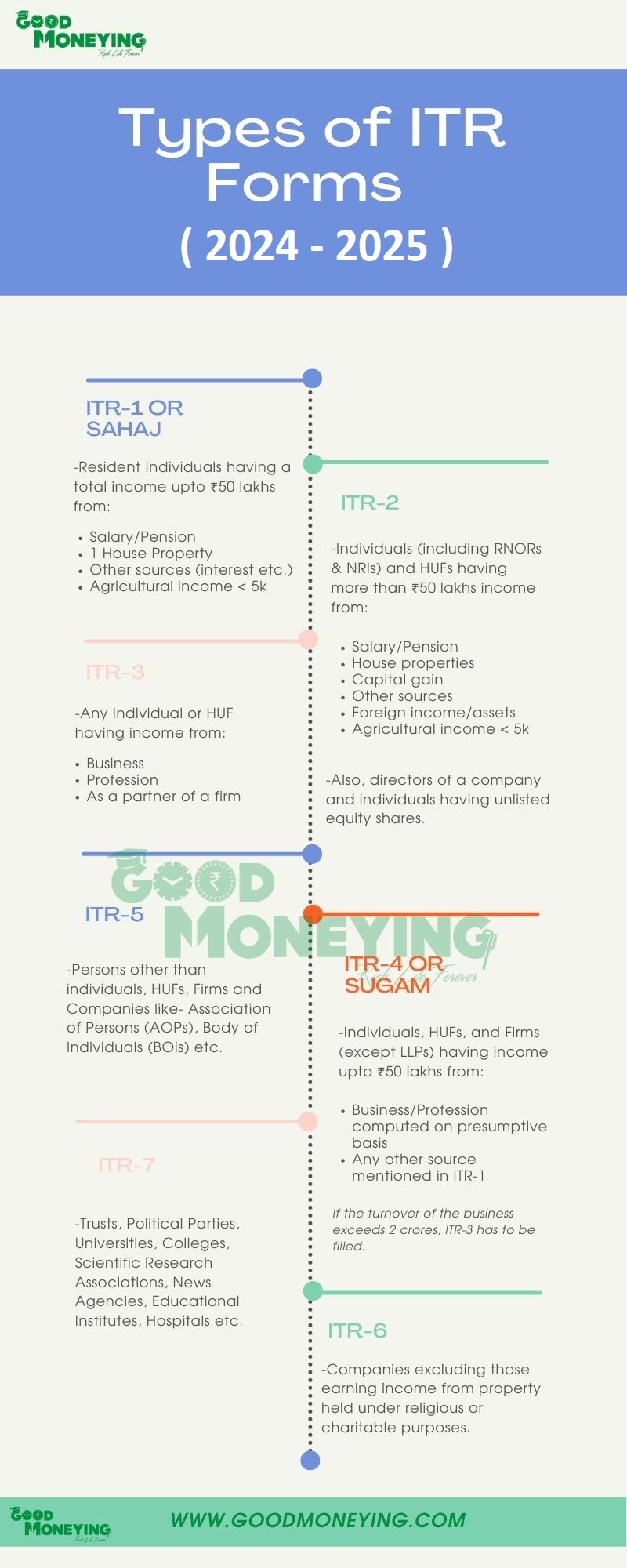

There are 7 ITR Forms (ITR-1 to ITR-7) applicability of which varies depending upon the source of income, the category in which the taxpayer falls into (individual, HUF, company, etc.), residential status, and so on.

In this post, let us discuss who should file which ITR Form and are there any specific changes in ITR forms for AY 2024-25 or FY 2023-24.

Types of ITR forms for AY 2024-25

Let’s see the details of the Income Tax Return forms applicable to Individuals and HUFs:

- New ITR-1 or Sahaj – For Resident Individuals with income upto Rs.50 lakh:

ITR-1 is meant for individuals only. If you are a Resident Individual having income for the Assessment Year 2024-25 (Financial Year 2023-24) upto Rs. 50 Lakhs from any of the following sources, you need to file ITR-1 or Sahaj ITR Form:

a) Salary/Pension. (Read: Decoding the components of salary slip)

b) House property Income (One Property), no losses brought forward from the previous year.

c) Other sources, particularly interest income.

d) Agricultural income is less than Rs. 5,000.

In case, you have income from business or profession or capital gains, you are an RNOR / NRI, director of a company or you own foreign assets or foreign income, you cannot use ITR-1 or Sahaj ITR form for AY 2024-25 or FY 2023-24.

Structure of ITR-1 or Sahaj:

It is the simplest of the ITR Forms, containing only a single page. The form is divided into the following components:

PART A- General Information like- name, PAN, DoB, communication details, Aadhar No. etc of the assessee.

PART B- Gross Total Income

PART C- Deductions and Taxable Total Income (Read: Income Tax Deductions )

PART D- Computation of Tax Payable

PART E- Other Information like- bank details, TDS/TCS, Advance Tax, etc.

You can download the new ITR-1for AY 2024-25 form here. - New ITR-2 – For Individuals, HUFs, and NRIs/RNORs:

This form is to be used by individuals and HUFs. If your total income exceeds Rs. 50 Lakhs in AY 2024-25 (FY 2023-24) from all or any of these sources- salary, house property & other sources (including lotteries and horse races), you should file ITR-2 in AY 2024-25. Also, if you are:

a) Having income from capital gains. (Also Read: Capital gain rules you may not be aware of)

b) Having agricultural income exceeding Rs. 5,000

c) A director of a company

d) Holding investments in unlisted equity shares or ESOPs

e) An RNOR or NRI (Read more on the RNOR status here)

f) The owner of foreign assets/ earn foreign income

In short, if you are an individual not eligible for ITR-1 and individual/ HUF having no income from business or profession, ITR-2 is applicable to you for AY 2024-25 (FY 2023-24).

You can download the new ITR-2 form for AY 2024-25 from here. - New ITR-3 – For Individual and HUFs with Proprietary Business Income:

ITR-3 is for individuals and HUFs who have income from proprietary business or profession or as a partner of a firm. The return may also include income from salary/pension, house property, capital gains, other sources, etc.

The new ITR-3 form for AY 2024-25 can be downloaded from here. - New ITR-4 or Sugam – For Partnership firm with Presumptive System:

ITR-4 or Sugam ITR Form can be used by individuals, HUFs, or partnership firms (excluding LLPs) having total income upto Rs. 50 lakhs and have opted for the presumptive system of computing income.

However, if the business turnover exceeds 2 crores then ITR-3 has to be used.

The return may also include income from all sources applicable to ITR-1. The new ITR-4 can be downloaded from here.

The below infographic would help you choose the correct ITR Form to file the income tax return for AY 2024-25. It also contains the ITR forms for corporates, trusts, and other assesses.

What are the changes in ITR Forms from AY 2024-25 or FY 2023-24 for individuals and HUFs?

To reduce the compliance burden on taxpayers, especially the salary income earners, there are no significant changes made in the ITR forms for AY 2024-25 as compared to the previous years.

In the end:

Apart from selecting the right Income Tax Return form, it is important to download the form 26AS and verify all the details of specified financial transactions and TDS reported therein, before filing your ITR Form for AY 2024-25 (FY 2023-24). Any mismatch would lead to a notice from the Income Tax Authorities. (Also Read: All you wanted to know about Annual Information Statement)

Also, if you are a salaried employee it is also important to check out form16 (provided by your employer) and 16A, which would help you file your income tax return.

Form 16 contains all details of your income from salary, other heads (if reported to the employer), Deductions claimed under various sections, TDS deducted, etc.

Form 16A consists of TDS on incomes other than salary. For instance, form 16A is issued when a bank deducts TDS on interest income.

(Also Read: How to avoid TDS on interest income?)

Double-check the TDS details mentioned in form 16, form 16A, and Form 26AS and make sure they match. If there is any discrepancy would have to be sorted out by contacting the TDS deductor.

Click here for a step-by-step guide to file your Income Tax Returns both offline as well as online.

Hope this post helps you select the right ITR form for AY 2024-25 and correctly file your income tax returns. Feel free to ask your queries in the comments section below.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

I appreciate reading this information on ITR Forms. It is really helpful for person to choose ITR forms as per their requirement.