Employee provident fund or EPF is generally the first organized savings product that one experiences at the start of his employment career. The main purpose behind EPF is to help employees save a fraction of their salary and accumulate tax-free corpus to support Retirement. (Read a detailed post on the basics of EPF here)

But there are many instances where you may require money before retirement to pay towards important expenses like for Marriage, education etc. So it’s is important to know the epf withdrawal rules so if this is the only or one of the major savings that you are doing you can plan your finances in a better way.

When Gurinder, one of my blog readers mailed me his query on how to partially withdraw money from employee provident fund, I decided to write a complete detailed post on epf withdrawal rates, for the benefit of other readers too. His query was referring to my views on choosing between EPF or NPS. (Read more on NPS here)

Before going ahead with epf withdrawal rules, let’s understand some basics on EPF itself.

What is Employee provident fund (EPF)?

It is a compulsory saving tool, towards retirement where 12% of your basic pay (Plus DA or cash value of food allowances) gets deducted every month and deposited in an EPF a/c. Your employer also contributes the same figure, but out of his contribution 8.33% goes to EPS (subject to a maximum salary limit of Rs.15,000) and 3.67% adds into your EPF a/c.

It means that if the salary of the employee is less than Rs.15,000 then 8.33% of his total salary would go into EPS. And if the salary is more than Rs. 15,000 then a maximum of 8.33% of Rs.15,000 i.e. Rs. 1,250 would be diverted into EPS, the rest would go into the EPF account itself.

The EPS portion would be used to offer pension to the member employee in the event of attaining superannuation/retirement, permanent/partial disablement, pension to the nominee in the event of death etc.

However, you may also choose to more than 12% of your salary, then you may do that by opting for the Voluntary Provident Fund (VPF). However, in EPF employer has no compulsion to contribute the increased amount.

(Also Read: 6 Safe Investment options in India)

This EPF a/c earns annual interest (currently 8.50%, tax-free) which is declared every year by EPFO (Employee Provident Fund Organization), a statutory body of the Indian Government under the Labour Ministry, in consultation with the Ministry of Finance.

EPF is a long term savings tool that stays with you until retirement. It is compulsory to register with EPFO, for all organizations which have employed more than 20 employees. However, for some organizations not having more than 20 employees or meet certain other conditions laid down by the EPFO, both employer and employee contribution has been reduced to 10%.

Thus it is imperative for you too, to know the epf withdrawal rules, so you can plan your finances to manage the expenses towards major life events.

In Budget 2021, it was proposed that interest on Employee Contribution to EPF/VPF beyond Rs. 2.50 lakhs per annum would be added to the total income of the individual and taxed as per Income-tax slab rates applicable, from FY 2021-22.

EPF withdrawal rules: At the time of Resignation or Job Change:

EPF withdrawal rules say that it is illegal to withdraw epf while making job switch. You can withdraw epf only when you have no job and 2 months have been passed since your last employment, in other words you should be unemployed for at least 2 months. Though in practice this does not happen as it is not possible for EPFO to track these things and employee also finds convenient to clear off the account while leaving job, as he assumes hassles in claiming back the money later on.

However, with effect from December 6, 2018, this rule is tweaked a bit. You may now withdraw 75% of your EPF corpus after remaining unemployed for one month and balance 25% if not employed for 2 months.

Besides the legal angle behind it, from the financial planning perspective also it is not advisable to withdraw your EPF while switching jobs. Tax-free interest, compulsory savings, equal employer contribution, and annual compounding make this product very attractive from a long term savings point of view.

In fact, one should use the transfer facility and transfer the balance lying in one account to the new employer’s account. These days it has become quite easy with the launch of “UAN – Unique Account Number” which is allotted to every employee and will remain the same throughout the employment career. Now you will not be given a new account number every time you switch the job. UAN will make transfer and management easy. Online transfer is possible through the EPFO website.

As UAN is applicable to current and future jobs only, all old accounts which are there from earlier employers have to transferred separately through online mode.

Here’s a post in the Business standard which will guide on “How to withdraw money from Dormant EPF a/cs”

EPF withdrawal rules – during Job tenure:

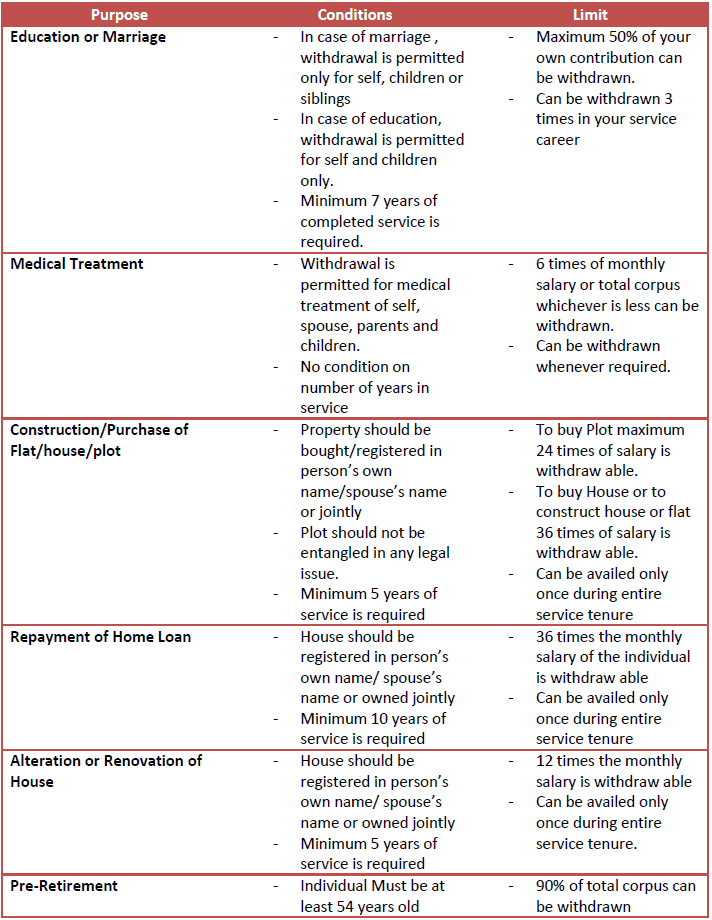

There are various conditions laid down for premature withdrawal of EPF balance. Individual has to satisfy the criteria laid down under epf withdrawal rules to be eligible for the withdrawal. Below are the purposes for which you may withdraw EPF while on Job:

EPF withdrawal rules, also allow some special situation withdrawals like on early retirement due to permanent and total bodily or mental disablement, in case of individual migrated abroad for taking employment or permanently settling there.

As per latest rules, 90% of the EPF balance can also be withdrawn for the down payment of new house and the EPF account can be used to pay EMIs as well, if the employee is a member of a housing society of at least 10 members and have continued the EPF account for at least 3 years.

Also Check- Online & Offline Process to transfer EPF account from old company to new company

Taxation on EPF withdrawal

EPF withdrawal rules say that any withdrawal after completion of 5 years of continuous service will be tax free in the hands of recipient. But if 5 years has not completed than the full withdrawal amount be taxable and all the tax benefits earned in the last years of contribution will be reversed.

As per new epf rules announced in budget 2015, any taxable withdrawal of epf will be subjected to TDS@10% if Pan is registered or @30% (maximum marginal rate) if Pan is not registered. But in case the withdrawal amount is less than 50,000 then no TDS will be deducted. Also you can submit 15g form at the time of withdrawal if his income does not exceed the basic exemption limit after adding the epf withdrawal amount.

Also Check- Top 8 EPF How-to Questions Answered

EPF Withdrawal Rules- Conclusion:

EPF withdrawal rules clearly states that even though this is a long term savings tool, it has necessary liquidity features attached. Still it is advisable to have proper plan at place for your different goals, so you can allocate different instruments towards those goals. EPF is meant for retirement savings, so as long as it is possible you should not withdraw out of it, but if emergency strikes and you don’t figure out any other way, option is there.

Do you find the information on EPF withdrawal rules helpful? If you have any query or want to share your experience , please share it in the comments section below.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

Thanks for the article. Very helpful information.

I am glad you liked the article Surbhi. Do share it with your friends too.

If I withdraw my PF amount, will I get my EPS amount too?

Thanks in advance.

EPS can be withdrawn along with EPF if employee’s total service period is less than 10 years. EPS withdrawal has different rules. Unlike EPF withdrawal where you get 100% of the deposit amount, in EPF you will get proportion of the deposit which depends on the average monthly salary (maximum considered as Rs 6500) at the time of EPF withdrawal. There’s one Table D which is referred for the EPS amount calculation.

For withdrawal of PF for renovation of house are there any documentary requirements. Eg Approved plan of Municipal authority or architect’s estimate for renovation etc. Or simply an application will suffice. Please guide me on this.

Mr Banerji, PF withdrawal forms does not ask for any documentary proof. But yes you have to fill the declartion form along with, where you will mention the details of authority which approved the site with reference number, also you have to mention the estimated cost.

Pls go through the link of those forms as below

Form 31 – http://www.epfindia.com/Forms/Forms_Instructions/Form31.pdf

Declaration – http://www.epfindia.com/Forms/Forms_Instructions/Form31_Declaration.pdf

Dear Sir,

I have a query.

I started my job in Aug 2009 and was in employment with the said company till Feb 2012. My PF was being deducted and deposited in EPF a/c ( I have a copy of the latest Statement of Accounts with me). My new job is with a very small firm and it does not deduct/deposit PF and therefore, there is no PF available to me as of now. My chances of working with the new company or new type of company where PF would not be deducted/available are very high.

I want to withdraw my earlier balance lying in my PF a/c. I want to know:

1. Whether I can withdraw my PF balance lying as of now.

2. Will I be subjected to payment of income tax on the withdrawal as I have not completed 5 years of continuous service.

3. If I do not withdraw PF right now, whether I will be getting interest on my PF balance since there is no deposit in the account since Feb 2012 (more than 3 years period).

You are requested to kindly give your valuable advice to me so that I can take decision accordingly.

Thanks & regards

Kamal Garg

Kamal, please find my answer below in the same sequence of questions:

1. Yes, you can withdraw your PF balance as of now.

2. Yes, as your PF account was not funded continuosly for 5 years, your withdrawal will be taxable.

3. After 3 years of non contribution, PF account will become dormant and earns no interest.

Today’s livemint carries almost the same question. Here’s the link for your reference http://www.livemint.com/Money/jIA2ZprHo2cXHEd331MmFI/PF-account-gets-interest-upto-36-months-with-no-contribution.html

Hello Sir,

Nice article and very helpful to me. Now i want to withdraw my PF amount and it is nearly 50k. so please me suggest some investment ideas for 50 k so that i can receive 75 k after 3 years.Please suggest some MF schemes for it.

Thanks for your help.

Vishal Patel.

Vishal,generating 50% in 3 years means around 14.50% compounded growth. Expecting such returns in short span may lead you to make big mistakes later on. Better to tame your expectations.

I am not saying that you cannot generate this return, but nothing is guaranteed. Equity MFs are market linked which gets influenced by many factors and most of which are in no one’s control. So you have to accept the expected growth along with real risk/volatility.

for 3 years time frame you may try balanced funds …icici prudential balanced advantage may suit you. but do consult your personal financial adviser before going for it.

Sir I have a one question when I first fill up epf opening form (2no nomination form) so this time 1signatre doing a correct position but 2 signature mistakely doing a employer position but luckily epf office accepted my form nd opening my account but I did not understood in future can I simply get my epf money not face the problem so I recently I contacted to my nearest epf office ND there r tell me my mins employees signature is not be impotent ur employer specimen signature is matching is most important so its true ? ND one question if fill 2 no revised form so my problems can be solve plz help me

What i understand from your query is that you have opened a new EPF account through your employer and in the form you mistakenly signed at wrong places, but even after that your account has been opened. Now your query is that, if this create any problem at the time of withdrawal?

I think there should not be any problem as what is important is your signatures, as your employer’s signatures are already in their record.

I just started my job, it’s my first job and I resigned after 3 months. Can I withdraw my epf ?

Sir,

I would like to know about the Employee Pension Withdrawl. I have completed 9 yrs of service. My basic is 13100/. How much would i get at the time of withdrawl?

Dear Mr Singhal…. We appreciate your valuable suggestions!!! I wish to understand what all documents would be required for withdrawal of EPF on House purchase clause. Do we need to first buy house / Do registration and then apply for EPF withdrawal.

Regards,

Vijay K

Dear sir

I had worked a company 4 years ago, i know my pf number, now can i withdrawn my pf amount? My account now un acctivate mode. What i do?

yes, you can withdraw your Pf amount.

An employee has joined us whose salary is more than 15000/- p.m. in our organization. He was member of Provident Fund previously, however, he has withdrawn full amount of PF and now he do not want to become the member of PF and also filled Form no. 11 . Whether it is compulsory to make him member again in view of the fact he has joined us with salary more than 15,000 p.m. and has also withdrawn full PF accumulation ??

EPF rules applies to the firm employing more than 20 employees. If your firm has less than 20 employees, then the rule doesn’t apply to you even for that employee whose salary was subjected to PF in Previous organization. Still, its better if you take opinion from a Lawyer expert in labor laws.

Hi my name is utkarsh , I have read your arrival it great .

Just want to know . I started working and I have pf account from 2006 , since then I have change two different companies till 2013 , after that I have started my own business , my pf account is static since then . I want to withdraw my pf money from all the pf accounts . please let me know few things below

1 ) is it possible

2) I have to pay TDs or no

3) is there any deductions from employer contribution

Please let me know

Regards

respected sir, i want to know about withdrawl of EPF on the basis of construction of my house .problem is that my house is in rural area under lal dora (lal lakeer in rural area) which is not able to register so what evidence i can give in place of registry of my house?i completed my 5 year service in company.other elligibilties are fullfiled. please guide me sir

Lovedeep, better to ask this question to your HR department. I might not be able to help you on this. Sorry

dear all

i have worked almost 8 year one pvt company but company has been closed no one is there like NO HR NO ANY OTHER PERSON IT WAS BANGALORE BASED COMPANY I WANT TO APPLY MY EPF NOW BECOZ I HAVE SO MANY PROBLEMS ANY BODY CAN PLEASE HELP SOON AS POSSIBLE…… waiting for ur reply

BEST REGARDS

ARUN KUMAR.S

Ph no 8971711129

Few years back even my wife faced such issue. So i visited local EPFO office and they after checking their records, agreed to accept the withdrawal request but on authorisation of the EPF commissioner of the region where the respective company was situated. So in my case it was delhi. I visited the EPFO and met the commissioner, and work was done. It definitely took time, but finally it got done.

Though now EPFO has come up with online withdrawal process, but i am not sure if it would work in your case or not

I worked 10.5 years Continuous Service in Private Organization (Nov 2004 to March 2015)

Last year March 31st 2015 I left that organization. After 60 day I made request for PF with drawl, Final amount credited in my Account with 10% Tax deduction.

How can I get that money back? is there any way

Well, this is strange. After 5 years of continuos services, there should not be any TDS deduction as the EPF amount has become tax free. Hope you have calculated it right, as some part of employer contribution goes to EPS and EDLI.

Otherwise, you can claim this amount by filing ITR

Hi Sir,

I am working in a Pvt Company from 2006 and now I have resigned and going to join a new organization from August 2016. Can I withdraw my complete PF now?

Thanks in advance!!

Hi Sir,

I was Working in a Pvt company from March 2014 to April 2016. but I leave the job without resigne. How can I withdraw the PF ? Plz tell me Sir.

Hi Sir,

Can EPFO check that I have been employed and withdrawing PF from my previous employer using my UAN. Since it is illegal, what are the repercussions on withdrawing PF from previous employer when in a job

Hi Sir,

I worked with my previous company during period October 2011 to October 2015 and I withdraw my PF amount in June 2016 submitting form 15g and 15 h and thus no tds was deducted when I received the full pf amount.I like to know how to file itr for FY 2016-17. Do I need to go back and file revised return for each year of pf’s contribution or do I need to show the whole pf amount received as income from other sources while filling it for 2016-17.Please assist.

You don’t have to revise your old returns, just show the PF amount as Income from other sources ( as you have not completed 5 years ), and file ITR accordingly. Still better to take help of some CA

Hi Sir,

I have experience of 6.7 years(4.4 years[1st organization] & 2.3 years[2nd organization]) with 2 different organization. When I switched from 1 to other transferred my PF to the new PF account. Now I quit the job. I wanted withdraw my PF. My previous employer shared me 3 files (Form 10C, 19 and 15G). Is I am eligible for tax free withdrawal also why should I fill Form 15G if eligible for tax free

You are eligible for tax-free withdrawal as you have completed 5 years with your PF account. Employers generally want to secure themselves by sharing all the documents, and since they do not know about your Previous tenure with the Old employer. Still, ask your employer if the Declaration by you should not be enough?

Dear sir,

I have gone through new PF deduction rules which states that for tax free PF withdraw, work tenure shall be 5 years minimum. But not mentioned whether it should be on continuous basis and in a same organization.

As, In my previous organisation I worked for 4 years .. Now i joined new organization but since we are very less in numbers my PF is not getting deducted for last 10 months. but now we are in sufficient numbers and our organization going to deduct my PF.

So my question is that after completing deduction of PFfor 1 year in my new organization and 4 years of PF deduction in previous organization … means in total 5 year PF deduction .. shall I able to withdraw my PF on a tax free basis?? Please confirm

Regular PF deposits in the respective account should be continuous for 5 years to make the withdrawal tax free. and to withdraw PF you have to remain out of job for at least 2 months.

In your case, since you did not withdraw PF after leaving a job , and now your new employer has started deducting /depositing your PF after 10 months of Gap and that too in the same account, so I believe it should be tax-free, after another 1 year of contribution. Rest it all depends on the rules prevalent at the time of withdrawal.

Rest, it is always better to transfer the epf to the new employer rather than withdrawing it while leaving the job.

HI, can i withdraw my pf without pan card ? my service is less than 5 year and amount is less than 30,00.

Please reply m waiting for apply online. and i did all formalities of aadhar and acc no.

Pan should be provided. Though you may withdraw the PF amount, in that case, TDS will be deducted at maximum marginal rate.

Sir,

I have one query regarding pf withdrawal. I resigned from my organization 18 months back after working there for 2 years.Now I see I have accumulated some interest in pf account in the meantime and has increased to 46k.I wish to withdraw that amount, so please help me understand whether it will be taxable or any other deduction will happen on the amount upon withdrawal, if so then how much I can expect roughly upon withdrawal

Firstly, if you are in a job then you will not be able to withdraw the EPF. If you are jobless for at least 2 months then only you are eligible to withdraw the EPF money. and yes, that would be 100% taxable as you have not yet completed 5 continuous years

As you are withdrawing your PF before 5 years, it is taxable.

Dear Sir

I have worked for a organization for around 20 years and my PF was being deducted since the year 1999. However recently our organisation faced financial crisis and hence no salary or PF has been paid since last two years. I have not resigned yet since my salary and PF is pending with the organization for more than 20 months. However, to cover family needs, without resigning I have joined another organisation and they are also deducting PF and now on the EPFO website there are two separate PF accounts under my UAN. I am not sure if it is legal to have two accounts under the same UAN.

My current age is 45 years and I have around 4 lakh rs under my previous employment PF account. I do not really want to withdraw it since it is getting good compound interest. I just want to know how should I deal with this, should I withdraw it or should I leave it as it is so that it can continue earning interest.

You wise advice will be highly appreciated.

This is strange since UAN itself is your PF account number and the purpose of UAN is not to have different PF numbers when working with different employers. Still, i would suggest you get the PF amount transferred to the new account. You need not withdraw it. Ask your current company’s HR for the process.

Dear Sir,

I have Entered Exit Reason In PF Account of some employees As “Retirement”(R) instead of “Cessation” (C) . When theleft employees applying for online PF claim then his/her claim rejected by EPFO. The details mentioned there is “Retirement from service after attaining the age of 55years”. Please suggest how can I rectify this mistake.

I have worked in a MNC ofr 9 Years and 8 months and have been contributing to super annunation fund all these years.

Now i have resigned from the organisation and joined a new one.

Now i would like to withdraw the complete fund which is accumulated for the last 9 years.

Please support me to get clarified on the below queries

– Can i withdraw 100 % of the superannuation fund

– If yes, what will be the taxable amount for 9 Lakhs

– If no, What is the maximum amount i can with draw

– Can i convert the remaining amount to pensionable income

Thanks for your support to answer these queries

– Can i withdraw 100 % of the superannuation fund

Yes

– If yes, what will be the taxable amount for 9 Lakhs

100%

– If no, What is the maximum amount i can with draw

– Can i convert the remaining amount to pensionable income

NO

Greetings ! I have resigned my earlier job after 19 years of service, and have joined my new job after a 3 month break. Can I withdraw my EPF from my earlier company in part / fully, and if so, what would be the tax payable. Also, is it advisable that, instead of withdrawing, i leave it in there and continue with my EPF in the new company (anyways since both of them are tied under the same UAN). Thanks.

EPF is a good Retirement savings tool earning tax free interest. It is aways advisable to continue the account till your retirement

I was working for Company A since October 2011, and left it in July 2016 to immediately join Company B. Company B created a new UAN, and was left with two UANs in the process. I tried transferring the earlier PF account of Company A to Company B thru EPFO portal, but the request got rejected and then was somehow able to raise Form 19 and got PF withdrawal of Company A with 10% TDS. My question is, is this withdrawn PF amount taxable since I have been in continuous service for more than 5 years?

Since your tenure with company A was not of 5 years, that’s why TDS was deducted. But if you could have transferred EPF of Company A to the new UAN then you could be spared of this TDS. Now as you have already withdrawn the money and this can’t be credited to the new UAN, so you have to bear the burden of taxation, which is not limited to 10% only…Check with your CA and file ITR accordingly

presently i have balance in pf account is 10lac how much i can withdraw for land purchage

As per our understanding, you may not be able to withdraw your EPF balance for purchase of land.

My pf got rejected reason not eligible insufficient balance

want to know about the PF, I have got my UDIN no where my last pf was deposited in Feb 2018 and then I switched my Job to a new organisation.

In my new organisation they started a new PF account. and left my last job in September 2019,

I am not working anywhere as of now and want to withdraw part of my PF money from which account I should withdraw the fund and what will be the Tax libality

As per our understanding, the new epf rules states that no individual can have two accounts. Your old PF Account have to be merged with the new one. So, technically it would be one account only, from which you may withdraw money.

Also, whatever you withdraw would be added to your income and taxation would be applicable as per the income tax slabs.

As per our understanding, the new epf rules states that no individual can have two accounts. Your old PF Account have to be merged with the new one. So, technically it would be one account only, from which you may withdraw money.

Also, whatever you withdraw would be added to your income and taxation would be applicable as per the income tax slabs.

Funds for EPS of EPFO are transferred out of EPF account of the employee. While withdrawal of EPF on retirement is tax free how come the pension out of EPS is taxable? There is no extra contribution of employer or Govt. in the EPS. So don’t you think pension under EPS of EPFO should also be tax free like withdrawal of EPF on retirement?

I understand your concern. But unfortunately, It is something stated in the income tax laws. There is nothing much we can do about it.

Last year October i swithced my job to different company and i need to withdraw the PF amount from previous employer which is a exempted trust one. Is it possible or legal to withdraw the PF amount from previous employer since I am currently working

No, it is not legal and even wise to withdraw your EPF while in job, It is one of the safe investments with steady returns so you should continue with that.

Unemployed from last 1 yr need PF money for treatment

Since you are unemployed for more than 2 months, you are eligible to withdraw your PF money. Apply for the online withdrawal of the same.

However, if you require the money for treatment of self/family members then you may withdraw it during job tenure as well.

Hi,

PF Transfer is getting rejected with “MEMBER JOINED AFTER 01/09/2014 WITH WAGES MORE THAN RS 15000/- NON EPS MEMBER.CLARIFY EPS MEMBERSHIP ”

what I have to do get it resolved.

thank you