Capital gain tax is a known term for all investors of Equity, Debt or Real estate. The gains made on capital assets are further classified into 2 categories i.e. Long-term Capital gains and Short-term capital gains, based on their holding period.

For Listed Equity, equity mutual funds and Related products the Long-term holding period is 12 months and more, and short term is less than 12 months.

For Real Estate, the holding period required to make it a long-term asset is 2 years and less than 2-year holding is termed as Short term

For Non-Equity Mutual funds like Debt Mutual funds and Gold funds, even for Physical gold, the long-term holding period is 3 years or more and less than 3 years is short term for this asset.

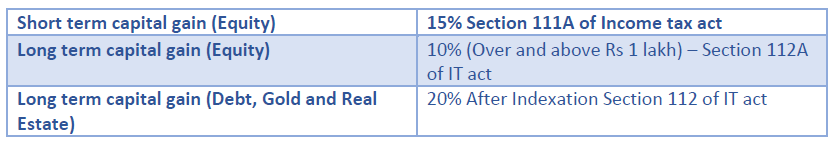

Not only Holding period requirement, but the capital gains tax calculations of these assets also have different rates.

Now for a regular investor, all this seems to be usual things and must be thinking that what’s new in this. I completely agree. But I am here going to share some not so visible rules which are generally not get discussed on common platforms.

Even if you are not that conversant with the Capital gain taxes in India, reading this article may help you make some sense of your investment taxation.

Capital gains tax in India – Important rules to be aware of

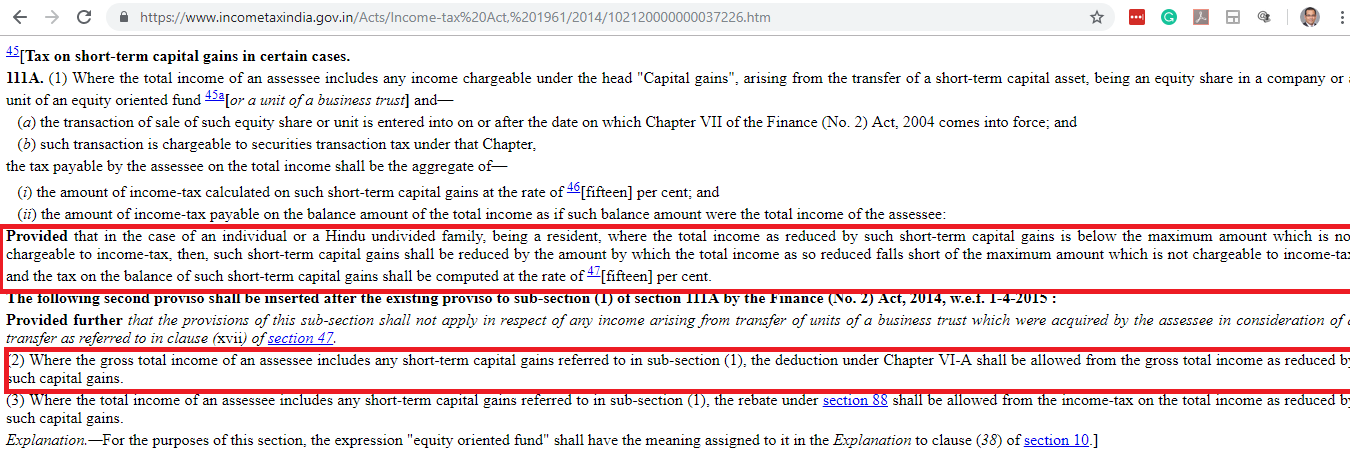

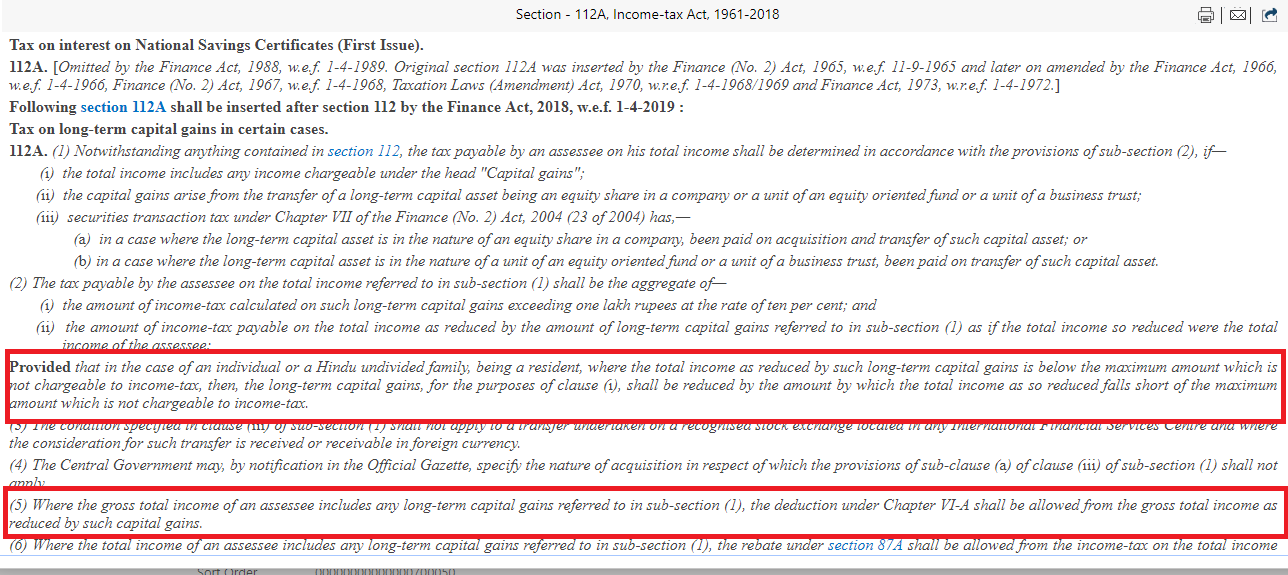

- Tax saving u/s 80C to 80U is not allowed to Capital gains

Tax Breaks under section 80c to 80U is not available to Capital gain Income.

If your Income is comprised of Capital gains that come under a special tax rate, you cannot save on tax outgo on the same by Investing in PPF, Insurance Policies or even ELSS kind of products.

Capital gains that come under special tax rates are –

* In case of debt funds, From April 1, 2023, all the Long-term capital gains will be treated like short-term capital gains and will be taxed accordingly. If you sell debt funds bought after this date, profits will be added to your income and taxed per your tax bracket. However, for investments before March 31, 2023, the gain is taxed at a flat 20%, with the bonus of indexation benefits.

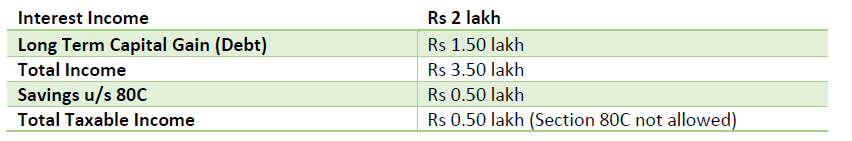

Let’s understand with an Example:

Mr. Suresh, going to Retire next year, has been investing in the Debt Mutual funds for quite some time, with a point of view of starting with SWP (Systematic withdrawal plan) from next year to supplement his monthly income. He is expected to generate Income of Rs 5 lakh per annum starting next year, which is expected to include Rs 1.5 lakh of Long-term capital gain.

Besides this, he will be earning some Interest income of around Rs 2 lakh from SCSS, MIS and other Interest-bearing Investments. To save income tax he is open to save u/s 80C.

His taxation would be as follows:

Now Question arises, Will the taxation be different if Mr. Suresh was an NRI?

2. NRIs Cannot Claim Basic Exemption Slab benefit for Capital gains Income

Yes, this is True. As per Section 111A and 112, NRIs are not allowed to adjust STCG (Except debt) or LTCG against basic exemption Limit. This adjustment is allowed only to Resident Individuals and Hindu Undivided Families (HUF).

Taking the example of Suresh as in Point number 1 above, If he was an NRI, then his Taxable Income would be Rs 1.5 lakh which is full Long term capital gains amount booked on debt mutual funds, he neither would be able to claim basic exemption benefit, nor invest in section 80C Instruments to save on the tax payment.

(Did you know: NRIs are not allowed to take Indexation benefit on Mutual funds?)

However, the Tax saving or I should say tax adjustment can be done if there is some Capital Loss booked by the Investor. This is possible through Set Off rules.

3. Set off the Capital gains with Capital Losses

When there is a restriction on saving on capital gains taxes, the provision of set off capital gains with the capital losses comes to the rescue of Investors.

The Capital Loss in one asset is allowed to set off with the capital gain in Other assets with the below-mentioned conditions:

Short term capital Loss is allowed to set off with both Short term and Long-term capital gain, and

Long term capital Loss is allowed to set off only with the Long-term capital gain

Till 1st April 2018, Long term capital loss in Equity was not allowed to set off with Long term Capital gain as LTCG In Equity used to be Tax-Free. But starting FY 2018-19, if you have made any Long-term capital Loss in Equity you can set it off with Long term Gain in any other Capital asset, be it Debt, Gold or even Property.

And If there’s no Capital gain available to set it off, then you may carry forward this loss for the next 8 years to be adjusted in future gains if booked.

Conclusion:

Income Tax is a Technical Subject. Every section comes up with different rules and Interpretation. From Tax planning Point of view, it is important to be in touch with the Professionals so you should not find yourself on the wrong side of law and end up in a soup.

Even me not being a Tax professional, have written this article after going through varied articles and sections on capital gains tax. Before acting on, you should take some tax expert in confidence, as rules keep changing.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

What about LTCG on NCDs/Bonds sold through stock exchange by payment of STT.

Would the holding period of one year will be the threshold or 3 years will be the threshold. Because STT has been paid and it is purchased/sold on a recognized stock exchange.

The threshold is 1 year in those cases and when STT has been paid they get eligible for Set Off rules

I transferred a parents house to my son and my son sold that for RS. 14 lacs.at the time of 2001cost of index and now cost of index of 2019(house sold in 8/2019.what will be the LTCG if cost of2001 is 5lacs.

The Cost would be taken as the purchase price at which the house was acquired by your parents. The indexation would be done on the fair market value in 2001, with the cost inflation index number of 2001 (100) and the cost inflation index of 2019 (289). The difference (sales price, as specified by you, 14 lakhs less the cost so arrived ) would be the capital gain/loss.

Hi Mani,

I read your article which was laid out well. I am an NRI and have a question relating to long term capital gains. I own stock from way back in 1990’s when I purchased them through public offer. Let’s say my stock is worth Rs. 1000 today but my cost was only Rs.1. What would be the tax rate on my gain.

I heard that the appreciation on the stock until Dec 31, 2017 is tax free and any appreciation after that point is subject to current capital gains tax rate. Am I right. Please educate me.

Thank you,

Hi Shreya,

Apologies for the late response.

Yes, you are right. As a general rule, gains till 31st Jan 2018 would remain tax exempt as per the grandfathering clause.

But if we go a bit on the technical side, the cost of acquisition to be considered for calculation, would be higher of- Actual cost of acquisition i.e. the amount you have actually spent on acquiring the share or the Fair Market Value (FMV) as on January 31st 2018 i.e. the highest trading price of the share on any recognized stock exchange on January 31, 2018.

For instance, Let’s say the share bought by you, listed on Bombay Stock Exchange (BSE), opened for trading at Rs 100, its closing price was Rs 99, and during the day it touched a high of Rs 102, then the FMV will be taken as Rs 102.

The rules further state that, if an equity share was not traded on the stock exchange on January 31, 2018, then FMV in such a case will be taken as the highest traded price on the day immediately preceding January 31, 2018, on which trade has taken place.

Now, to calculate the gains, selling price of the share has to be deducted from the cost of acquisition so arrived. Gains exceeding Rs. 1 lakh (per financial yr) would be taxed @ 10%.

Hi Manikaran

My late non resident Dad gifted the flat to my son.The flat was purchased in USDollar by my Dad at CIDCO,Navi Mumbai.During 1992 or late there was a special scheme for Non Resident to invest in India.Now my son wants to sell this flat.Can you please explain what are tax implication and Capital Gains Tax.

Will be very grateful for your advise and input.

Regards

Hello Mr. Desai,

There is no difference in the capital gains taxation for NRIs. The tax implication will remain the same as applicable to the resident Indians. Since the flat was purchased in 1992, the gains would be long-term capital gains and would be taxed at 20%. Also, since your son is an NRI, the transaction would also be subject to TDS.

Good guidance. I have a question. I am 72 years old. I have received a part of the proceeds of a property purchased in 1993 out of the proceeds of the sale of my deceased father’s property. At my age, I am not interested in saving the capital gains tax. I wish to earn interest. Therefore, I wish to pay the tax and use invest the balance in bank FD as I will earn two percent extra interest as a senior citizen and ex-officer of the bank. Is it necessary to invest the proceeds of sale under CGAS? Can I place the ex-CG tax amount directly in bank FD?

Yes. If you are ready to pay tax…then you may do it, and invest the balance amount the way you like

Hi Mr. Mani,

I worked in abroad (Gulf) earned money and purchased land in india.

I sold land a year back and invested in trading but I lost almost 40 Lakhs.

Could you advise me, I don’t have money any more and decode to go back to gulf to work again.

If applicable, What are the possible way to reduce pay tax.

Tax on what? Income in Gulf countries are tax free. Could you please elaborate your query. or mail me at [email protected]