This is the second and concluding part of the article – “Should you switch your loan from Base rate to MCLR?” In the first part, I have explained what MCLR (Marginal Cost of lending rate) based lending is and how it is different from the base rate. If you have not read the same, then I advise you to go through that article first to have a better understanding of this one.

This article is more about the mathematics which one needs to do before taking the final call of switching the loan to some other reference rates.

The calculation will be similar if one decides to move from base to MCLR and if someone moves between banks. It’s just if you move intra-bank then you may be charged with transfer fee and if you move interbank then you may be charged with processing or filing fee. In both the cases, there would not be any loan pre-closure charges.

Things to consider before switching the loan from base rate to MCLR or to some other bank

- Outstanding Loan amount

- Outstanding tenor of the loan

- Difference in Interest rates

- Expenses (like switch fee, processing charges, filing charges etc.)

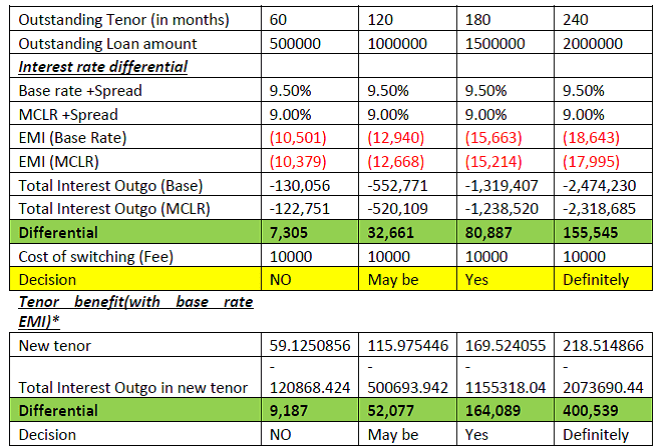

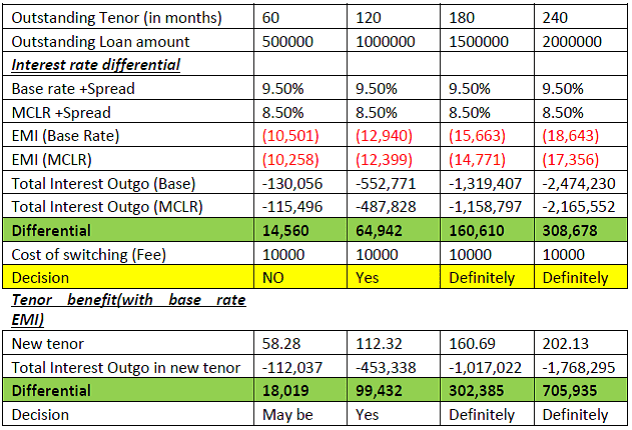

Let’s do some Maths to understand this in detail. From calculation perspective, we need to assume some of the things. Like for example, though floating rate of interest keeps changing depending on RBI policies and economic scenarios, but here we need to assume that the rate will remain fixed for the entire remaining tenure.

Other things to assume are the expenses, which may differ from borrower to borrower, tenor to tenor and sometime may get waived off by bankers. It may be charged as fixed or as some percentage of the outstanding loan, but here I am assuming it to be fixed and same for all tenors.

*Tenor benefit is something when despite reducing the EMI, bank prefers to reduce the tenor of the loan.

Now looking at the above calculation, it is very much evident that longer the tenure, higher would be the benefit of reduction in interest rates. The same impact you would find when the interest rate differential would be high, as shown in the below table

But the point here to note is that switching fee is a onetime expense, but the interest outgo is spread across in the number of years, and if we calculate the time value of money by discounting the cash flow, then the differential will further get reduced. This is the reason in 60 months period my decision is NO in both the cases since the difference in Interest differential and cost of switching is not so significant and which may get adjusted over time.

(Must Read: What happens when you cannot repay your home loan?)

Also, you must have observed that in tenor reduction option, the benefit is much higher. This is true, but in that case, the actual benefit will get derived only at the end, and when you have longer outstanding loan tenor, you cannot be sure of that benefit since loan interest rates keep varying.

Other important considerations before you decide to move on to MCLR based lending rate:

- You cannot move back to base rate once you switched your loan to MCLR

- Since MCLR is more connected to RBI rates and banking costs, so you will find more frequent changes in rates at every reset dates. The way you are finding it going downwards, you will see the same speed in rate hike too.

- Those who have taken home loans after April 1, 2016, are already at MCLR rates. If you are planning to take loan, then read –how prepared are you towards your house purchase

- Unlike MCLR, Base rates will not be changed so frequently so if you are comfortable in your EMIs, and your loan tenure is also less and you keep on pre-paying some amount every now and then, then in my view, you should not look upon MCLR based rates. (Don’t ask me to show you some calculations on this, because I can’t)

Conclusion: MCLR based lending rate is quite transparent and may look attractive in falling scenario, but in the long run, looking at average inflation rate, which is a good indicator of average interest rates, I do not see much of benefit in MCLR, as at the end I believe everything will get average out. For the time being maybe for next 3-4 years, you may enjoy lower rates, but in a growing economy like India, we should not expect such trend to continue forever.

For the time being maybe for next 3-4 years, you may enjoy lower rates, but in a growing economy like India, we should not expect such trend to continue forever.

Hope you find this article on “considerations before switching home loan from base rate to mclr” useful. You may ask your queries or share your experiences in the comments section below.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

But generally lenders are reluctant to reduce tenure or term of the loan because that’s their hard earned money which keep on coming for a longer period. Simple.

They reluctantly agree for only rate cut or as per the Loan Agreement would apply the lower interest rate. But tenure reduction seems a tough decision.

Hai mani ji it is very useful and crystal clear. I have taken a loan of Rs. 20 lakhs in that 12 lakhs of 6% SI (Staff loan) and another 8 lakhs (20 yrs) commercial rate ie (9.65 and now reduced to 9.55). I thought of switching to mclr but after reading your article i think so i should live as it is. Thanks for your guidance at all times. Be in touch always.

Thanks Suresh Ji. I am glad that i was of some help 🙂