Rohit was travelling to Himachal for holidays and decided to stop by to meet me en route. It’s been almost a decade since we last met. We used to study in same school. These days he works as a Project manager with some IT firm in Bangalore.

He was coming along with Family so we decided to meet at Home only. After having lunch, we went for a coffee to nearby coffee shop leaving his family at my home to relax.

Though Rohit was on holidays, with no work related pressure on mind but he was not looking happy.

What’s wrong with you Rohit? Is there anything bothering you? You can share with me, if you want. I may be of some help to you. I asked.

Bothering me? No, not at all. It’s just a hectic travel and I am bit tired.

After a long pause, he agreed that he wanted to discuss something, and this is one of the reasons he wanted to meet me.

Well, I guess yes. I need to talk to you. I think you could be able to guide me, with some good investment solutions to make my life better. Rohit said.

Investment solutions? Where does that come from? I mean if this is what you wanted to ask me then we could have talked over phone. I was sure there’s something more to his problem.

Mani, I feel I am not growing in life.

Oh, k. By the way, what made you feel this that you are not growing in life. You are doing good, no? Is there any problem in your job? I enquired.

No. I mean yes, my job is fine. In fact this April only I got promoted and got 20% increment. But something is there which is not right.

Well, all my colleagues in office, some have big houses, some have big cars, Some have both, their kids are studying in high end schools, some go on exotic international vacations every year, and look at me, the same old average guy as I was in school, going to Himachal for holidays.

So what’s wrong with Himachal? I asked.

Himachal is not Europe Mani, this is wrong. I have been working for the last 12 years and don’t feel like if I have achieved something in life. I cannot give my children a better and comfortable future. All this is making me tense.

Is that it? This is your problem? Quite a serious issue, I must admit. But you know, I have a solution to it, not linked to investments. Let’s order coffee first then we’ll discuss.

See, the issue here is not what other people are doing but what you like to do?

Look at you, you also have started blaming me now. Rohit got a bit uncomfortable.

No. Please don’t get me wrong. See, you must be having more or less equal salary package like your colleagues. But still you feel you don’t have that much of assets and that kind of lifestyle which they have, Right? Now here is not the question of affordability but more about values. I am sure, as far as I know you, you also have done something good with your money, and accumulated some decent savings.

Moreover, whether they are living a comfortable and low stress life or not, is anybody’s imagination. Reality can be different which only they know.

Big house or Big car is nothing, even you can buy that. It’s all about looking at your cash flows, selecting a property and signing few loan documents. But then you also need to know how you are going to service those long term high end debt, by managing with the savings required for your goals. Stress of defaulting on EMIs and its future repercussions is much more than stress of not having own house at all.

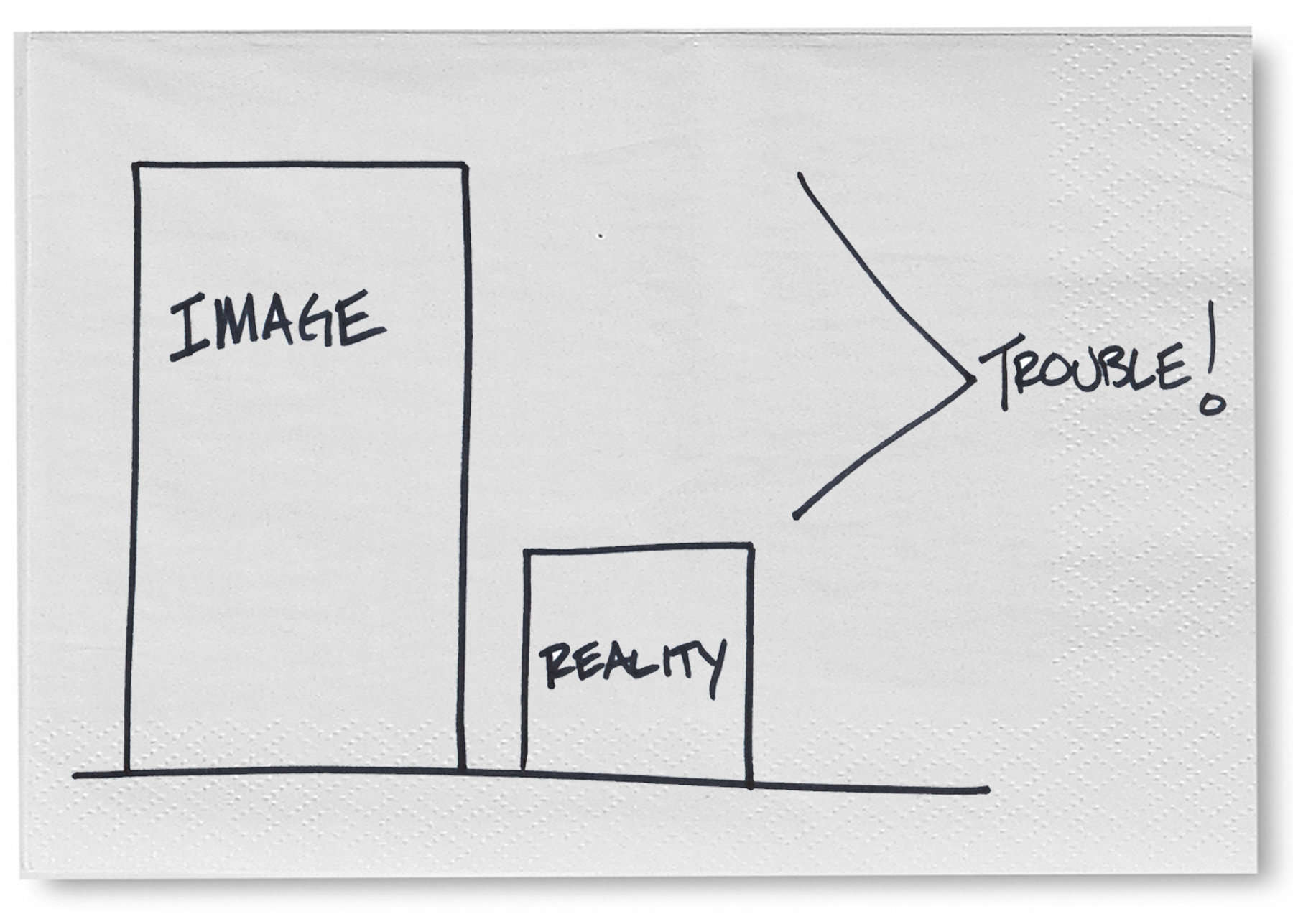

Image courtesy: nytimes.com

Moreover how can we comment on other person’s financials when we know nothing about it. I mean you may be aware of their salaries, but what about their family background, Assets, liabilities, other sources of income, Parents profile, spending structure…. there are so many variable attached to it that you just cannot comment. And you also are not sure if they are actually making or breaking their financial life.

Carl Richards in one of his article wrote – (I made Rohit read the complete article on my mobile phone)

Wait Wait…Suddenly he interrupted. What is Net worth?

Howzzat!! You have caught the right word Rohit. Well done!!

Net worth is your financial reality. It is a number which tells your real financial standing as on date. Your net worth is the real parameter of your financial growth. This is a difference between what you own and what you owe. Say for e.g. you have one car worth Rs 10 lakh, but there’s one loan outstanding against it of Rs 5.5 lakh. Then your real net worth is Rs 4.5 lakh, though from other person’s eyes you have Rs 10 lakh of car, but the reality is that your ownership in that car is of just Rs 4.5 lakh.

Net worth is the figure that truly provides you a sense of security and financial freedom, which your high income may not.

If your net worth is growing year on year, than you are also growing, even if your income is stagnant. But if your income is growing but no net worth then there’s the problem. Income helps in building networth if used wisely, but at the end only net worth is dependable and not income.

Now you may understand that just looking at people and assuming that if they are spending big they are growing, is not a sensible way of judging someone’s growth. And by the way why you need to know their details, in fact you should better focus on your numbers and look out ways to increase your net worth, by focusing on what’s important to you and what makes you happy.

You may have high net worth with less income and you may have low net worth with high Income. It’s all about how you use your Money. You may use it to create assets or you may use it to spend uselessly. In fact I am of the view that spending is not bad unless after that you start regretting that you could have spent on some other item too, or you could have bought something better than what your neighbors have spent on. You need to enjoy your spending and use your money as per your values. Just be aware, what you are doing and why.

Hmm…that’s interesting. Tell me more about net worth and why it is so important.

Take a Sheet of paper, draw a 2 column table. On one side list down all your assets like your investments ( real estate, stocks, Mutual funds), Liquid cash, bank deposits, Retirement assets, EPF, PPF, other savings schemes, Insurance Surrender values ( only Investment linked Policies), Personal assets ( Car, Jewelry), and also put down any loans receivable. You may also add any business equity too, but keep in mind that the value as per books of accounts and actual value may be different and also it is not easily liquid able thing.

Try to put their accurate or conservative values because people tend to add the emotional values along with the actual numbers especially with the real estate investments.

and on the other side list down your liabilities with the outstanding amount.

Total Assets minus Total Liabilities is your Net worth.

See, your net worth today is the end result of everything you have earned and everything you have spent until right now. It’s a kind of your financial report card. Your net worth will be more if you have spent or invested your money on productive/appreciating assets and will be less if you have spent it on depreciating assets or on consumption.

Net worth is as important as Personal cash flow planning. Tracking your net worth on regular (Annual) basis, gives you a general idea on its trend like whether you are growing or not. Like stock markets, it is normal for net worth to fluctuate as assets value keep on fluctuating, you pay off loans , you take loans, you use your assets to pay towards your goals…but what is important is its trend over a period of time. It is only your net worth that will give you a financial security when you will not be earning or on your Retirement.

Analysing your Net worth details and constituents will help in your financial health check up. You can figure out what kind of assets you have, What percentage of your assets are liquid enough so can be depended upon in case of emergency, what assets are productive, are you in right investment instruments. It will give you a clear idea on your Investments asset allocation too.

Your liabilities side will tell you on how high are you on consumer loans and other loans. It will show you your spending habits if you are high on credit card or on personal loan.

“Know your net worth” exercise will in turn also help you in working towards its improvement as you may want to close your high interest paying loans with low interest giving bank deposits, also you may get aware about your bad habits and you resolve not to repeat the same in future.

By the way Rohit tell me one thing, I know you can afford and money is not the problem with you, then why you’ve not gone to Europe for holidays, like your friends?

Well Mani, I wanted to explore India. I wanted to see every nook and corner of our country. Taste different variety of foods. I enjoy holidaying here. Moreover most of my money has already been mapped with my other goals.

See, you know the answer. You have not gone to Europe as it doesn’t excite you. I am sure even if you‘d gone there, you would not have enjoyed the holidays.

So in nutshell, you don’t know what is happening in other people’s lives, trying to know is a waste of time as this is none of your business. What you should focus is on your own growth and what you can do to improve the same. No Income but your net worth is a real parameter of your growth and financial well-being.

Keep growing…Good Moneying.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

Manikaran Singal is the founder and Chief financial planner at Good Moneying Financial Solutions. He is a CERTIFIED FINANCIAL PLANNER CM and SEBI registered Investment adviser (Regd no. INA 100001620). He’s having 20+ years of experience in financial services space.

Wonderfully explained Mr. Singhal. I guess the dilemma faced by your friend is a reality of today.

We are so focussed on what others have, it is creating a lot of stress in lives. Focussing on networth should be the main focus and not comparison with others.

Thanks Puneet. This is the reason it is said that Personal Finance is more Personal than finance. 🙂

Very well explained Sir. Worth reading, worth sharing and most importantly Worth Practicing.

I am a regular reader & follower of your blogs & articles. In fact I started investments only after reading your blogs. You made it very simple for beginners like us to understand the complexity of Financial World.

Huge fan of yours.

Thanks for spreading the financial wisdom.

Thanks Yogesh. I am glad to know that you are a regular reader. Keep coming, keep sharing.